The viral awareness and adoption of artificial intelligence foundation models such as OpenAI LP’s ChatGPT have created both an opportunity and threat to automation platforms generally and robotic process automation point tools specifically.

On the one hand, large language models can reduce complexity and accelerate the adoption of enterprise automation platforms. The flip side is that software robots are designed to improve human productivity through intelligent automation and GPT models could cannibalize some, if not many, use cases initially targeted by RPA vendors. This reality is causing customers to rethink their automation strategies and vendors to evolve their messaging rapidly to position foundation models as an accelerant to their platforms.

In this Breaking Analysis, we provide you with a perspective on how foundation models could have an impact on automation platforms. We review Enterprise Technology Research data that quantifies the ascendency of OpenAI. We also show survey data that measures the overlap between machine learning and AI systems and automation platforms. Then we review the recent quarterly performance of UiPath Inc. and share how we think the company must position itself with respect to the onslaught of noise and potential disruption from GPT models.

OpenAI has burst onto the scene in unprecedented fashion

Let’s start with a look at how rapidly OpenAI has rapidly entered the head space of enterprise information technology buyers.

Above we show a graph from ETR’s emerging technology survey, or ETS, which plots Net Sentiment on the vertical axis – that’s a measure of intent to engage with a platform – and mindshare on the horizontal axis. In just a few short months OpenAI has blown past all emerging companies that ETR tracks, including the well-established Databricks Inc. Now, of course, we’re talking about a predominantly free tool versus companies that are transacting serious business in the enterprise. But there’s no denying that ChatGPT has created a Netscape-like moment in the technology business.

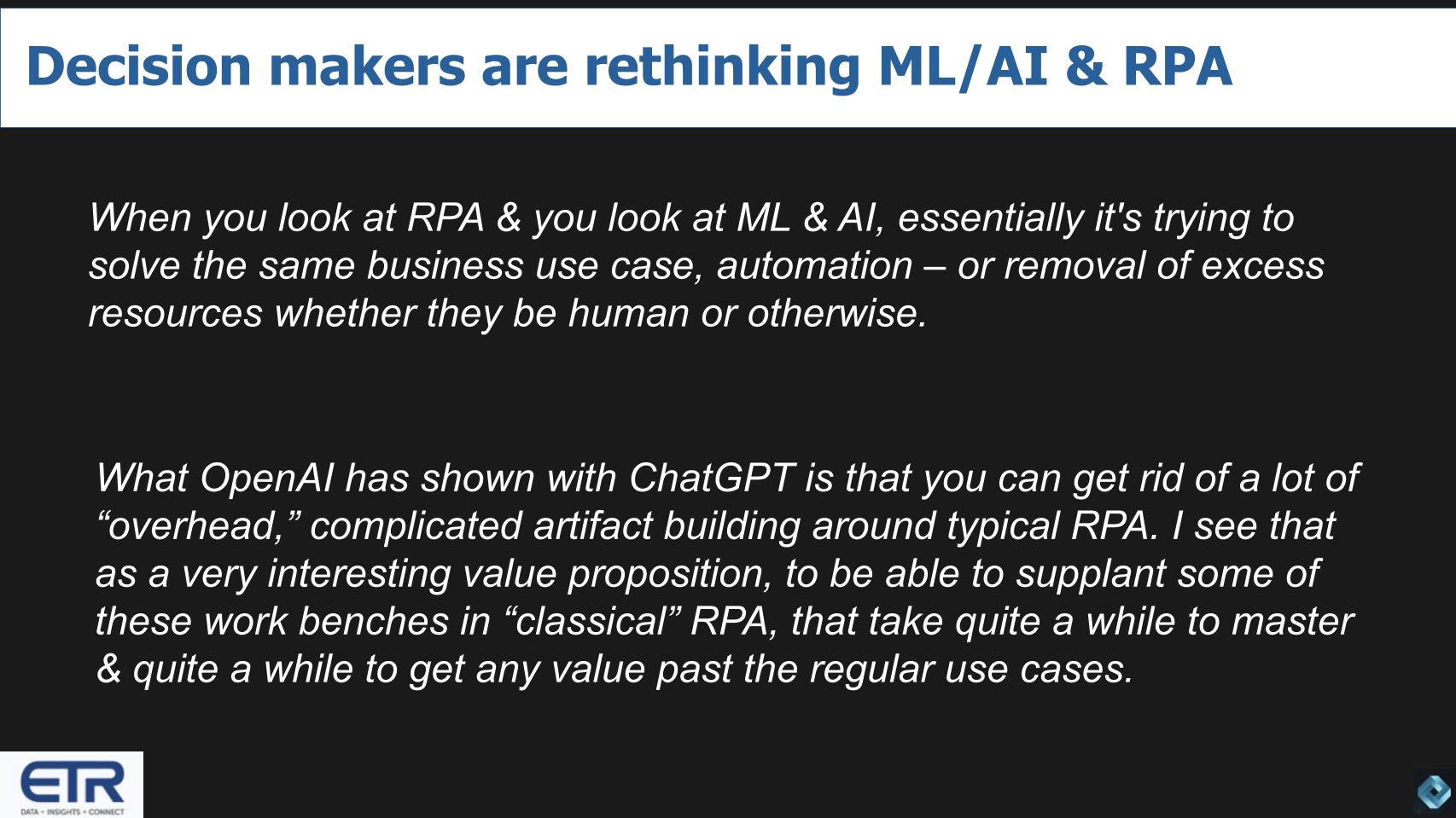

Foundation models are causing IT decision makers to rethink automation strategies

Below are direct quotes from chief information officers at a recent ETR roundtable. These quotes reflect several conversations we’ve had with users of automation platforms.

When you look at RPA and you look at ML and AI, essentially it’s trying to solve the same business use case: automation, or removal of excess resources whether they be human or otherwise.

What OpenAI has shown with ChatGPT is that you can get rid of a lot of “overhead,” complicated artifact-building around typical RPA. I see that as a very interesting value proposition, to be able to supplant some of these work benches in “classical” RPA, that take quite a while to master and quite a while to get any value past the regular use cases.

According to ETR’s Erik Bradley, there’s a very high overlap between people citing evaluation plans for OpenAI and the RPA customers in the ETR technology spending intentions survey, or TSIS. This is especially pronounced for UiPath. This data could mean that the two technologies are simply aligned together, or the more ominous view that RPA customers are evaluating OpenAI as a potential supplement or replacement.

Microsoft Corp.’s Power Automate also has a very high overlap, but Microsoft’s massive investments in OpenAI and integration into and across its platform more clearly will be a tailwind for the company. Later in this post we’ll protect how we see this affect UiPath specifically and RPA and automation vendors generally.

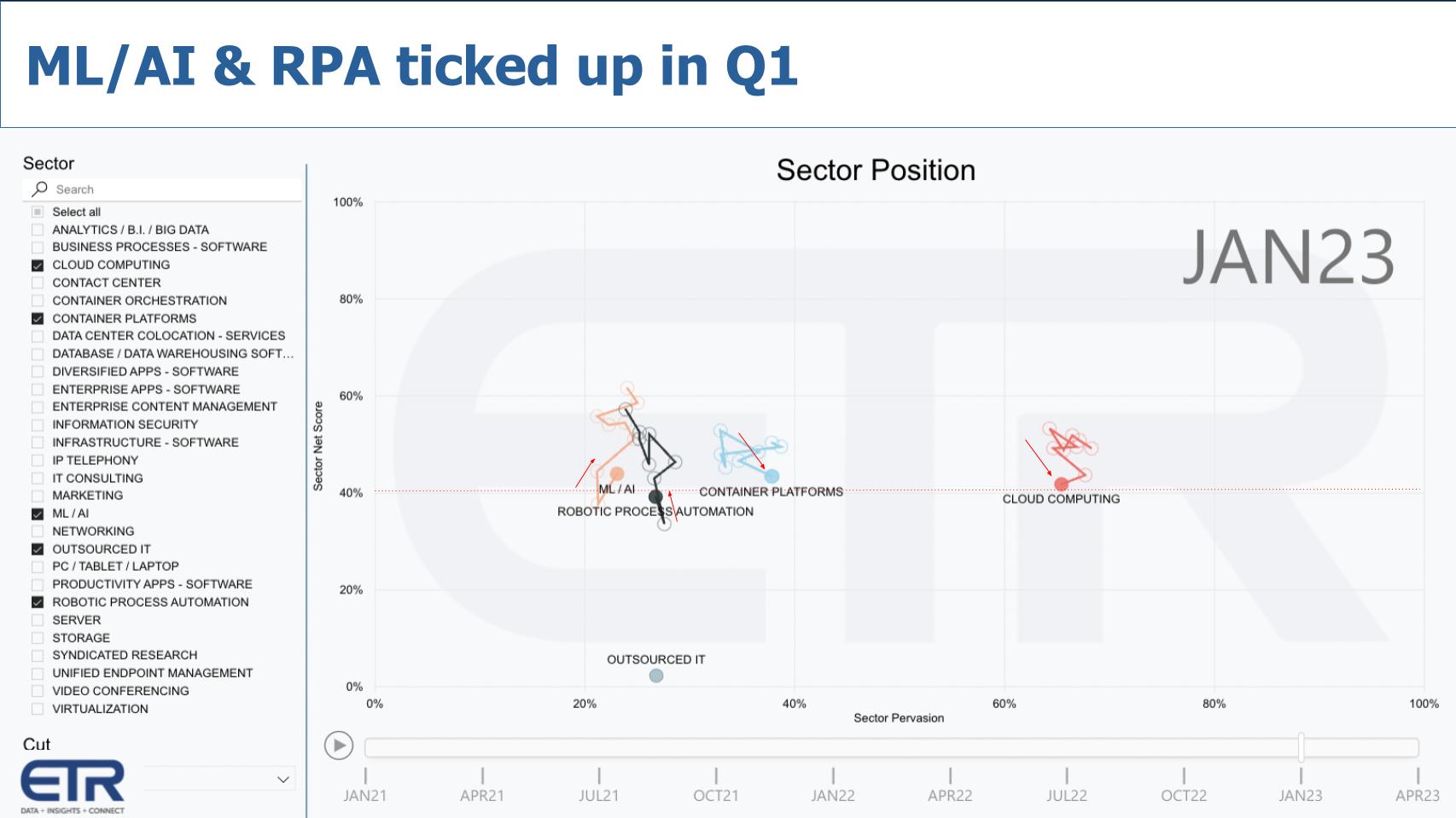

Demand for ML/AI and RPA ticked up in Q1

Let’s step back and take a broader look at the market in general.

The chart above is from the Q1 ETR survey of 1,500 IT decision makers. We isolate on the four areas with the greatest relative spending velocity: ML/AI, RPA, Containers and Cloud. The vertical axis is Net Score or spending momentum and the horizontal axis measures pervasiveness in the data set. We only show Outsourced IT because it’s very low on the momentum scale and makes it easier to see the big four. That red dotted line at 40% indicates highly elevated spending momentum.

As you can see, despite the broader tech slowdown, ML/AI and RPA rebounded in the Q1 survey and ticked up, while containers and cloud followed the downward market trend. This is perhaps due to two factors: 1) The dual combination of interest in AI from the buzz around ChatGPT; and 2) A rejuvenated UiPath which showed strong in the Q1 ETR survey and was proven out in the company’s Q1 results.

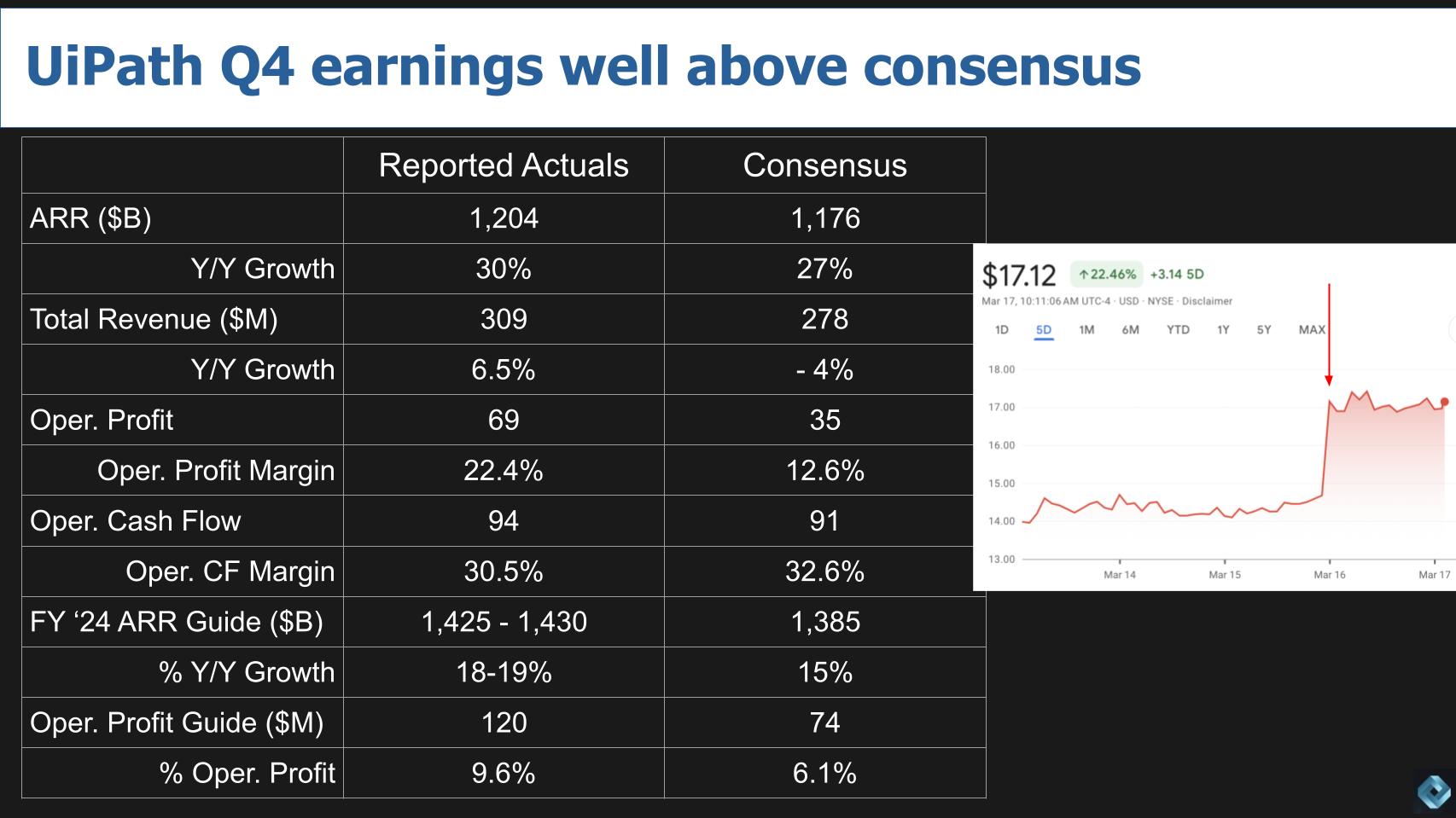

UiPath as a pure-play bellwether in automation

UiPath surprised to the upside in its Q4. The company beat and raised this past quarter and investors cheered. Below is a table that shows key metrics from the company’s Q4 actuals relative to consensus.

Not shown above is net new annualized revenue rate, which came in above $90 million, a very strong number and another important indicator. As well, net revenue retention came in at a more than respectable 129%. The company beat on virtually every metric and guided higher for FY 2024. Of particular note is the operating profit, which shows the co-chief executive structure seems to be working.

Rob Enslin came in from Google LLC to partner with Daniel Dines. Enslin is a go-to-market pro and Dines is an engineer, now spending more time in R&D while Enslin shores up the operation along with Chief Financial Officer Ashim Gupta, who appears to be doing a great job of communicating to the Street. The company has realigned its go-to-market with top decision makers and adjusted its pricing and packaging models with solution packs focused on key industries, including healthcare, finance, technology and other sectors.

You can see the uptick in the stock chart on the right side of this graphic, which shows how the stock reacted to the earnings news. At $9.4 billion, UiPath is still well off its $40 billion-plus market cap high and still has much work to do. Although one quarter doesn’t make a trend the financial discipline, focus, product investments and much improved communications are encouraging.

The questions investors are asking given the current market conditions, which remain unchanged, are: 1) Is UiPath’s performance bucking the industry headwinds; 2) Is this quarter more a function of fine-tuning the operating model; and 3) Is the company back on a sustainable track to consistent growth and profitability?

As well, foundation models such as ChatGPT loom as a potential disruptor, although investors appear to see AI as an enabler for UiPath.

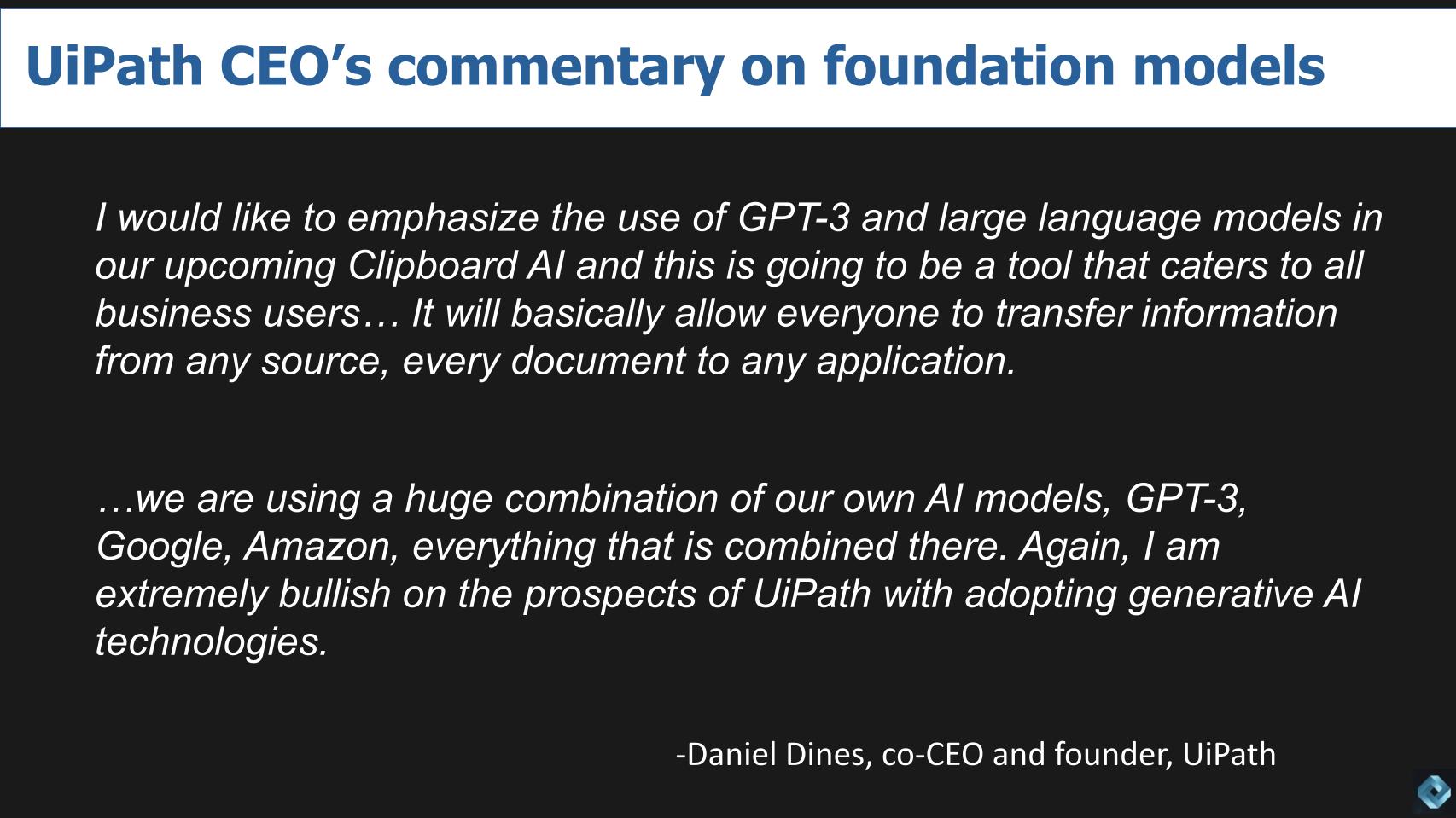

UiPath positions GPT models as a positive

UiPath co-CEO Daniel Dines had this to say on the earnings call:

I would like to emphasize the use of GPT-3 and large language models in our upcoming Clipboard AI and this is going to be a tool that caters to all business users.… It will basically allow everyone to transfer information from any source, every document to any application.

We are using a huge combination of our own AI models, GPT-3, Google, Amazon, everything that is combined there. Again, I am extremely bullish on the prospects of UiPath with adopting generative AI technologies.

Dines is underscoring that UiPath has been on the AI curve for quite some time and sees these developments as a positive. And the Street certainly reacted accordingly to that narrative.

Digging deeper into the intersection between AI and RPA

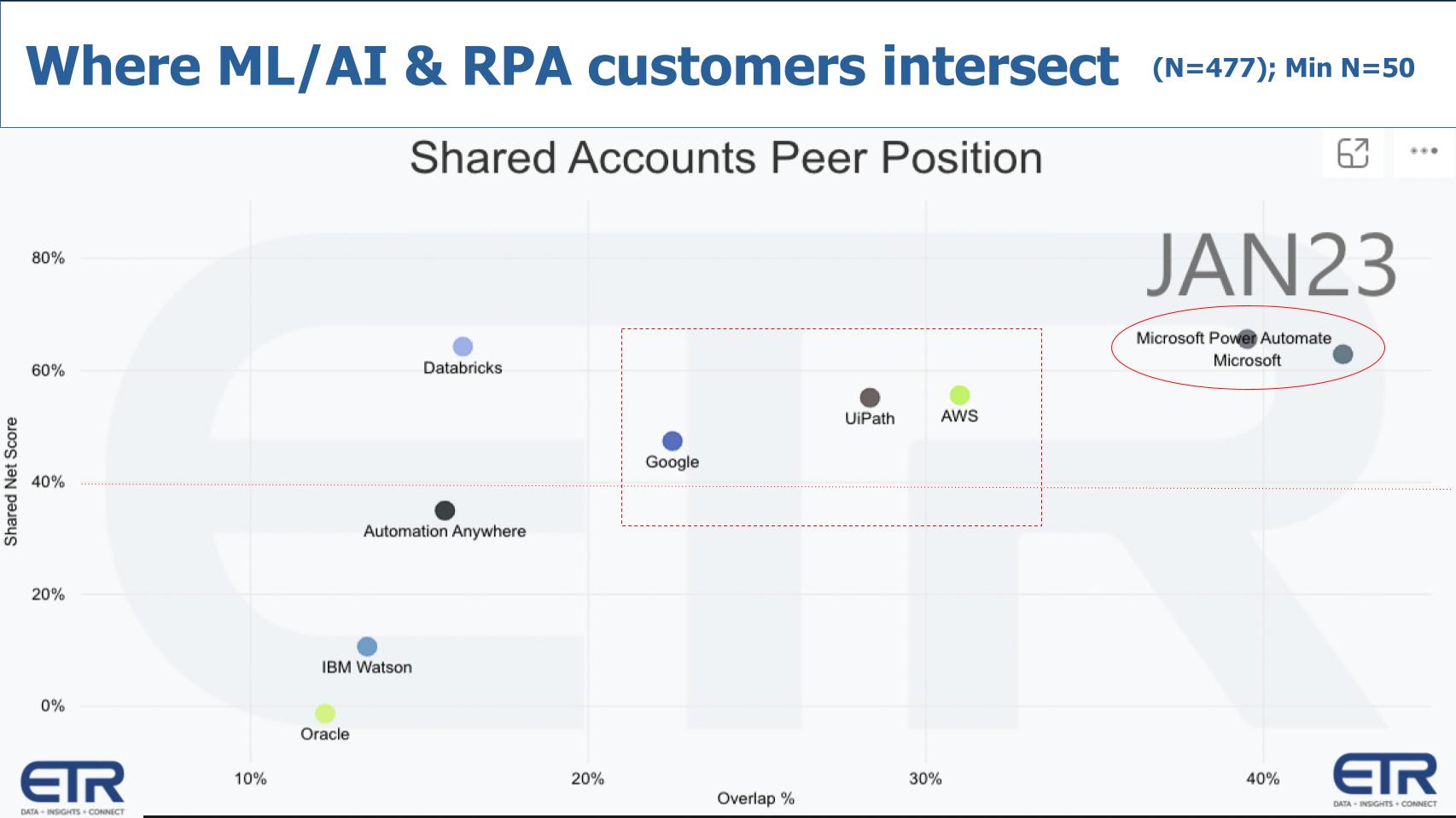

The chart below takes the ETR survey data and isolates it on those customers that are spending on both ML/AI and RPA. And it shows the platforms in which companies are investing. This cut takes the 1,500 N down to 477. We filtered the data on companies with more than 50 responses in this view to minimize the noise and keep the sample sufficient.

This chart above shows the same XY dimensions, Net Score or spend momentum on the vertical axis and overlap or penetration into the data set on the horizontal axis.

The takeaway is these are companies at the intersection of ML/AI and automation using RPA as a proxy. Microsoft, Amazon Web Services and Google, as you know, are leaders in AI, as is Databricks. IBM Watson and Oracle Corp. are the legacy giants maintaining their relevance and driving business value for their customers by integrating AI into their large estates.

What’s most striking is Power Automate from Microsoft and Microsoft’s AI offerings – both up and to the right. And this points to the future of how Microsoft is infusing AI into its entire portfolio and its RPA offering, Power Automate is no exception. Microsoft is well-positioned to capture wallet share and observers can expect its relationship with OpenAI will be a linchpin of its AI strategy. Microsoft was arguably behind AWS and Google in AI from a technology standpoint but appears to have jumped to the lead from a business model perspective.

That said, the No. 1 pure play, UiPath, is very well positioned on the chart above. The company is showing significantly above the red 40% elevated line. Automation Anywhere Inc. is more than respectable but doesn’t have nearly the market presence or the spend momentum of UiPath.

The bottom line is the two pure plays are up against some giants in AI and must out-innovate them in automation with laser focus, while at the same time partnering with AWS and Google and presumably Microsoft. Dines didn’t specifically call out Microsoft AI in his recent remarks, despite the fact that the company has always had an affinity with Microsoft. He did specify AWS and Google as AI partners. It’s likely that Microsoft’s acquisition of Power Automate, its competitive position in RPA and recent developments between Microsoft and OpenAI have led UiPath to be more cautious with its Microsoft relationship.

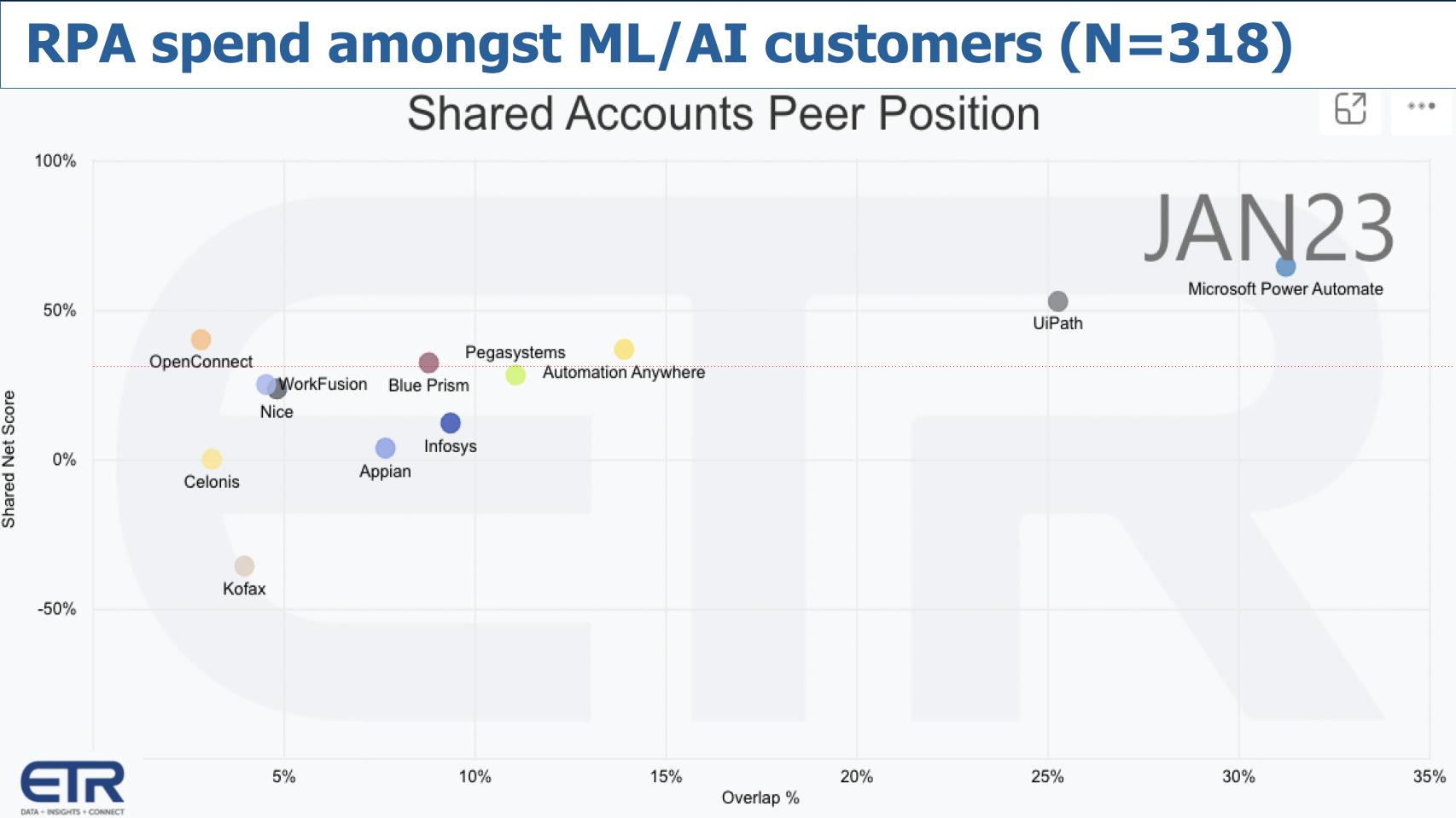

Microsoft and UiPath separate from the pack in AI accounts

Let’s take another cut at the data and look at how customers that spending heavily ML/AI are adopting RPA.

Same dimensions on the X/Y axes – Net Score and presence in the data set. This chart above shows spending on RPA platforms within those customers also spending on AI. The N gets reduced to 318, so we’re slicing the salami a bit more. But it’s clear that Microsoft Power Automate and UiPath are separating from the pack within the cohort of AI adopters. That said, a number of the others appear to be well-positioned – Automation Anywhere, Pegasystems Inc., Blue Prism Group plc and so on. And it’s imperative that all software companies, but especially automation firms, get ahead of the curve when it comes to AI generally and GPT models specifically.

How will GPT models impact RPA and automation platforms?

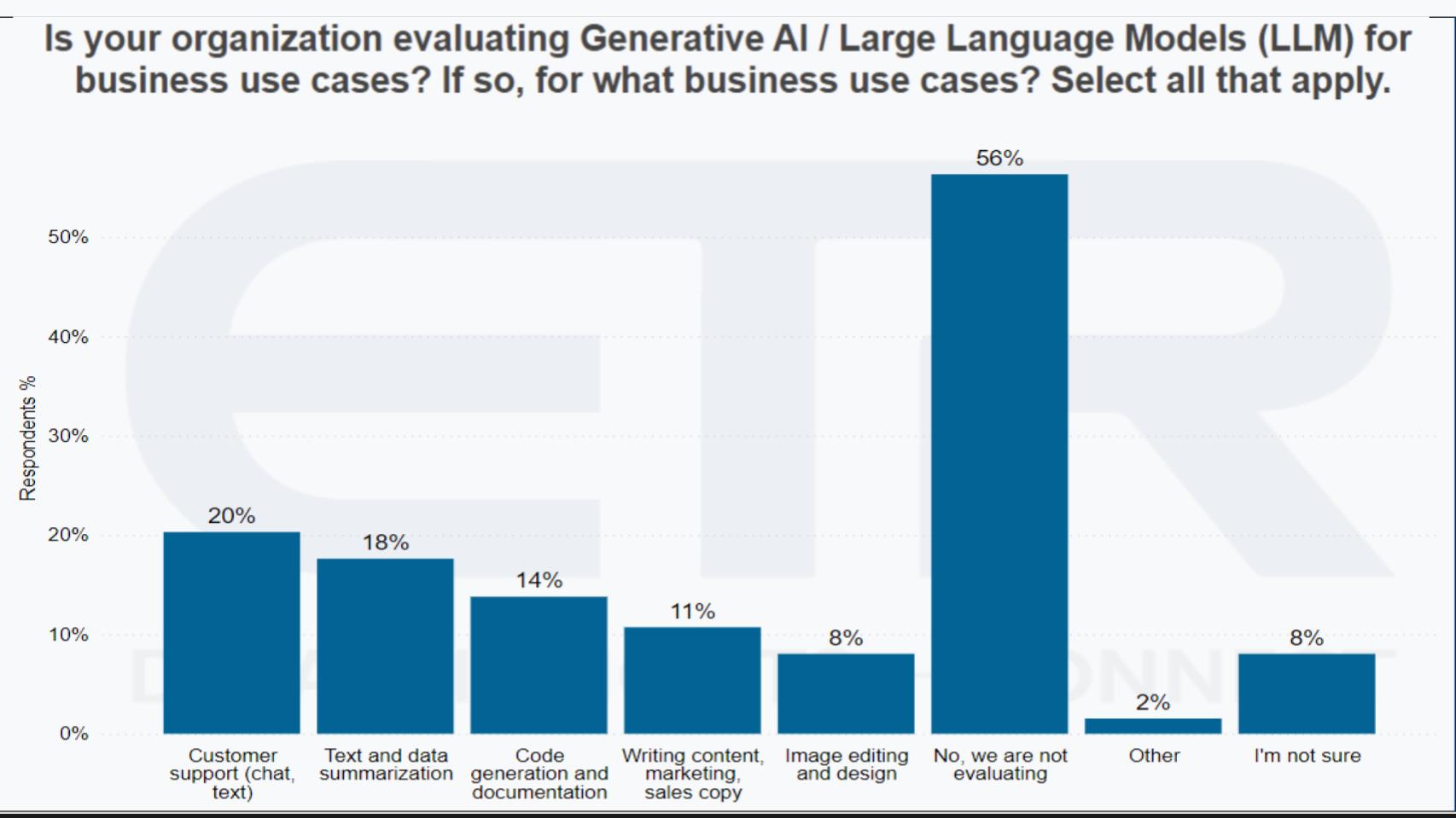

Now that we’ve taken a look at the overlap and intersection of AI and RPA, let’s dig into how customers think they may use foundation models and how that might have an impact on RPA and automation platforms.

ETR asked customers are evaluating GPT models and if so for which use cases. Fifty-six percent of customers say they’re not evaluating – which is a bit surprising; they’d better start. But of the ones evaluating, you can see below that customer chat is the main use case. That’s followed by text and data summarization, generating code and documentation, writing sales and marketing copy and finally image editing and design as the major use cases for GPT.

So at the surface, one would conclude that RPA and automation platforms could benefit from GPT models and that these use cases are largely complementary. For example, a foundation model could write or accelerate the development of automation code that could direct software bots.

But at the same time, there’s a looming overlap between the capabilities of large language models and some of the early RPA use cases; and this overlap will most likely grow over time.

How are automation platforms responding to the threat?

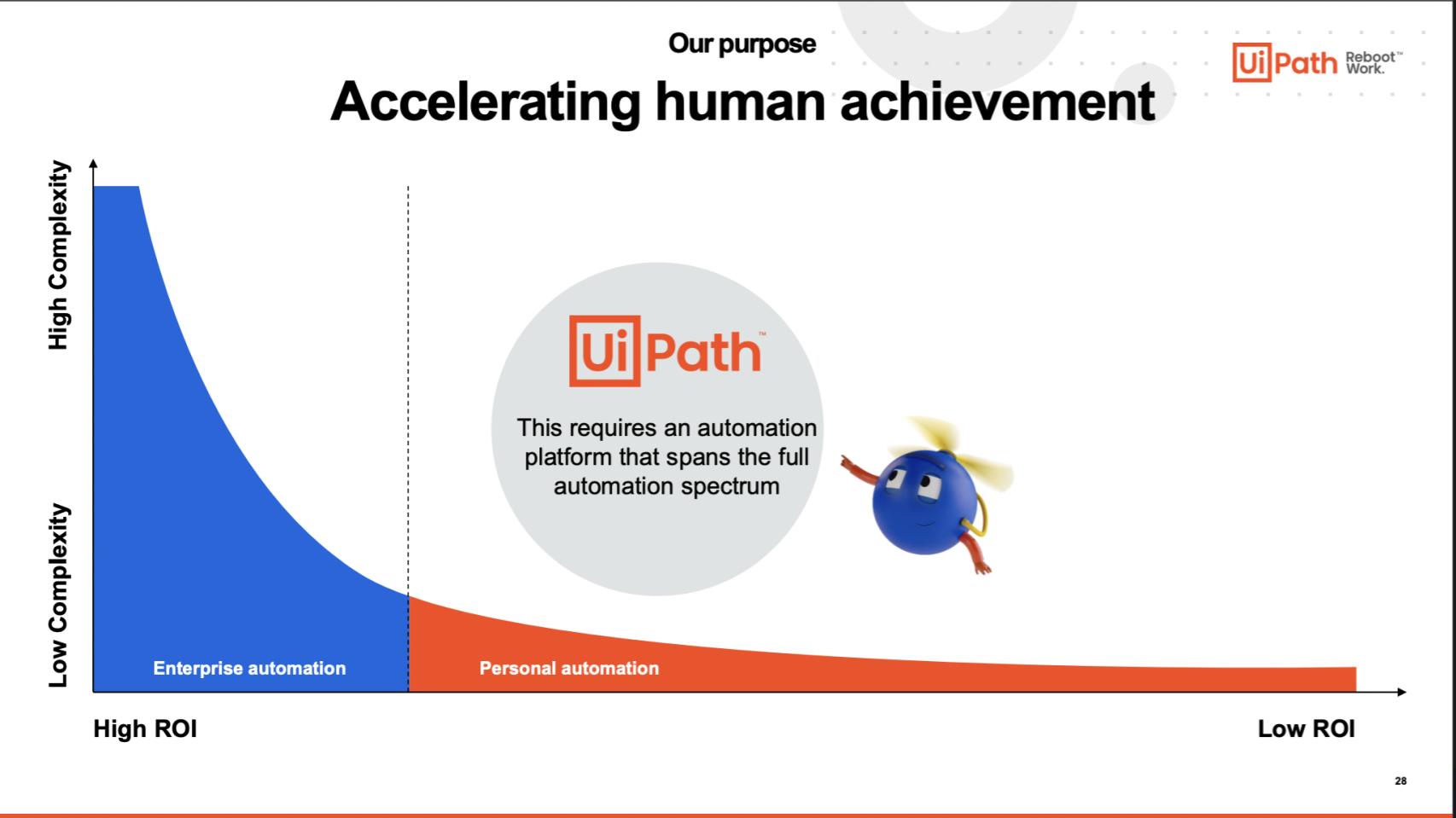

The graphic below from UiPath’s investor day late last year summarize how the company in our view is repositioning itself relative to personal automation tools, which is where it places Power Automate. But this positioning potentially applies to GPT models as well.

The blue area depicts UiPath’s value play and the orange is where Power Automate has traditionally focused (and by the way UiPath’s initial entry into the market). But through acquisition and organic development UiPath has expanded into process mining, task mining, application programming interface integration and conversational intelligence. As well, the company has moved from an exclusively on-premises model to a cloud-native platform. Cloud now comprises about a third of UiPath’s ARR.

The point is UiPath is repositioning itself. It launched new branding this month with a new tagline “The foundation for innovation.” And its go-to-market focus is heavily targeting the C-suite, where it can sell the value and become a more strategic supplier.

Enterprise automation platforms are rapidly evolving

To achieve this objective, the platform of UiPath specifically but end-to-end automation platforms generally must be extended. As an example, early UiPath implementations were about identifying mundane user tasks, building a bot or two, running the automations and then managing them. Pretty straightforward.

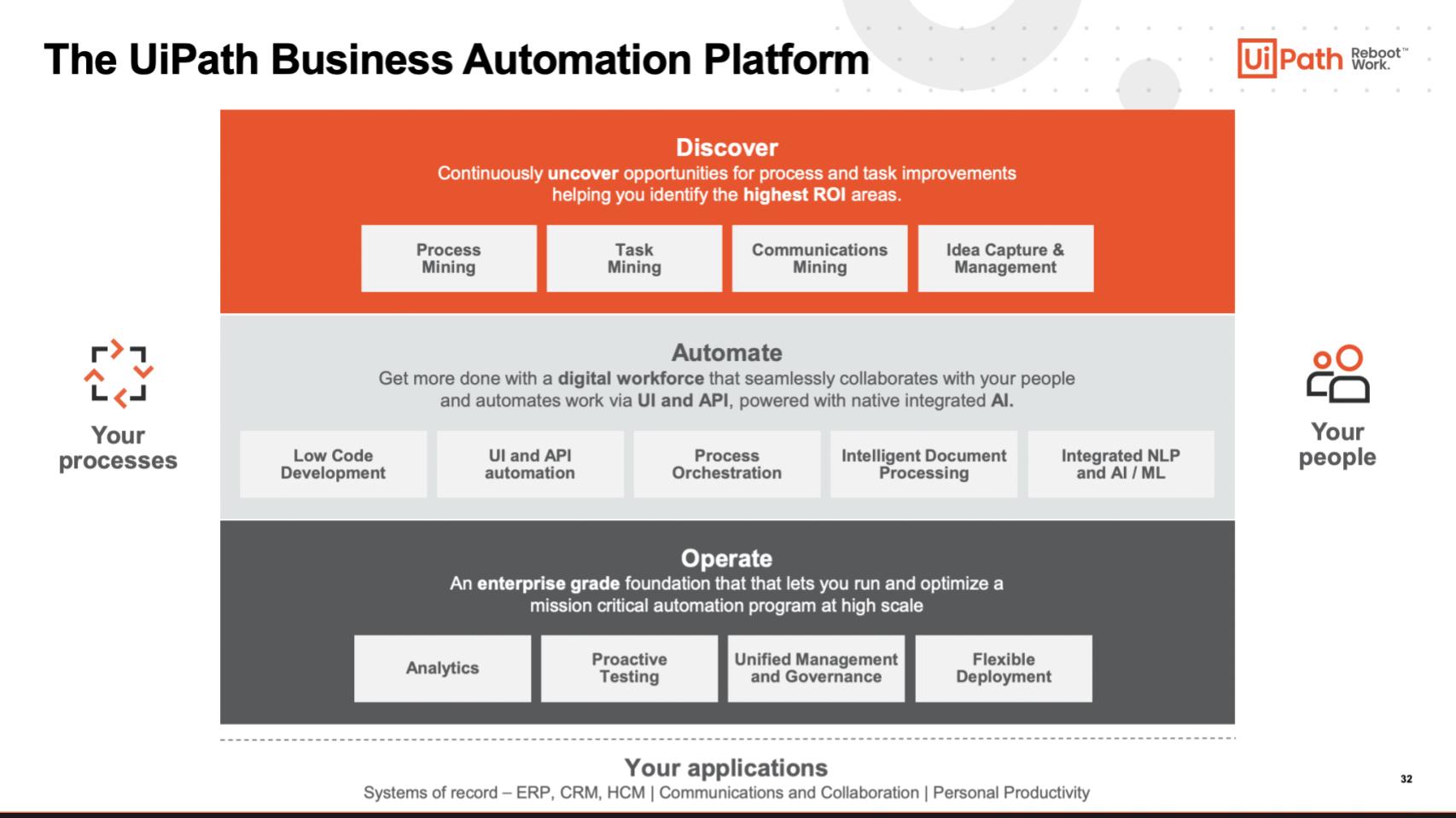

This chart below shows what UiPath’s platform looks like today:

As you can see, the UiPath platform has evolved quite dramatically, in a large part through acquisitions and integrations. Discovery through process mining, task mining, communications mining, ideation and so forth are supported by a spectrum of automation capabilities, some which are very sophisticated. At the bottom layer is a foundation of enterprise-class capabilities that the company hopes will differentiate it from not only Automation Anywhere, but from Microsoft, which never can be ignored.

Where do GPT models fit in this picture? The answer is basically throughout the platform. As Dines said they have a lot of experience with AI and GPT models and technology providers in this space are applying AI for discovery, automation of various tasks, simplified integration, code development, analysis, compliance and virtually endless use cases.

But there is overlap with GPT models and this will continue to be a fast-moving market. It’s likely that UiPath will continue to move upmarket and bring its large cohorts along the journey. And this is again a two-edged sword because UiPath has numerous customers that are smaller with lower annual contract values. The opportunity is to bring them deeper into automation nirvana, while at the same time differentiating from the “good enough” crowd, which increasingly will include GPT models.

Key factors to watch

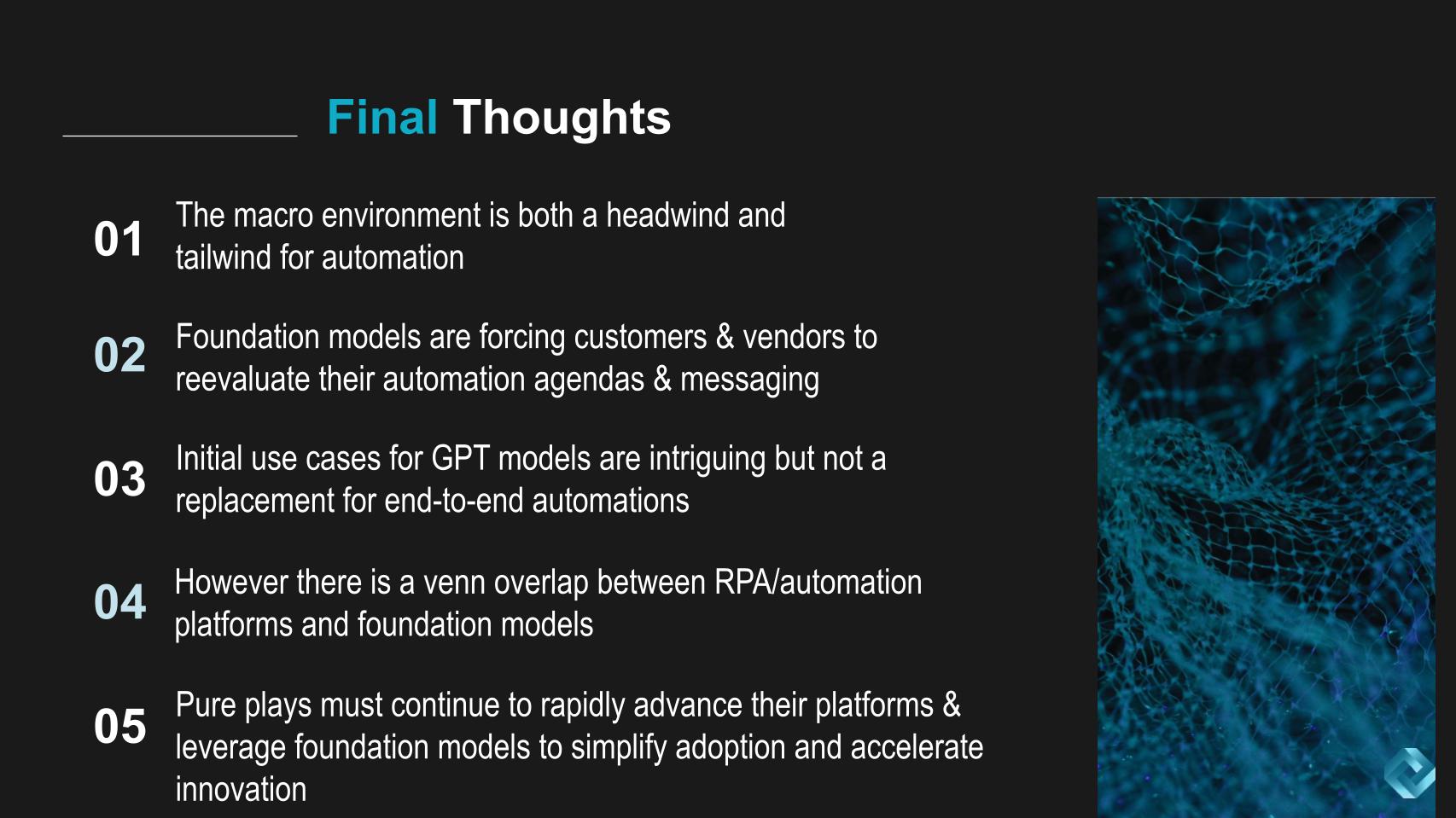

This market remains a tale of two cities: Tough times mean companies look for ways to cut costs and automation is a way to do that. But it does require companies to spend money to make money.

GPT models are catalyzing new thought and both buyers and sellers are pivoting to turn foundation models into opportunities.

Initial use cases for GPT models are interesting but not a direct replacement for enterprise automation platforms. However, low-end automations are at risk and there’s no question there is a Venn diagram here intersecting foundation models and automation platforms.

The bottom line is that pure plays such as UiPath and Automation Anywhere must continue to advance their platforms rapidly and differentiate themselves. As we said earlier in our RPA coverage: The No. 1 player will likely do really well. No. 2 will do OK and the rest of the pack will struggle somewhat as RPA pure plays and will need to find ways to differentiate. Nonetheless, all vendors in our view must leverage GPT models to simplify and accelerate adoption; and buyers have to step back and do some experimentation to see how they can deploy these new innovations to add value to their business.

We suspect at the end of the day that most companies will buy AI, not build it themselves — meaning they’ll consume it as part of their existing software-as-a-service platforms. And we think that bodes well for the UiPaths of the world because they can, through automation, connect data locked in silos because of the fragmented SaaS market. And this presents an opportunity to provide solutions that automate, translate, optimize, accelerate and aid in compliance.

Keep in touch

Many thanks Erik Bradley for his insights and contributions for this episode. Alex Myerson and Ken Shifman are on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Leave a Reply