Like any other organization, churches and ministries need to process their payroll and comply with IRS tax rules. Aside from managing pay processing and tax withholdings and filings at an affordable rate, the best church payroll services offer features such as church-specific tax law expertise that makes running payroll easier.

We evaluated 14 providers to find the best church payroll services and narrowed it down to our top six.

- Gusto: Best overall church payroll service with solid hiring and HR tools

- QuickBooks Payroll: Best for QuickBooks users and churches wanting fast direct deposit options

- OnPay: Best for church administrators needing robust system permissions to delegate payroll and HR tasks

- SurePayroll: Best for small churches wanting budget-friendly payroll plans with full-service and do-it-yourself (DIY) tax filings options

- Rippling: Best for tech-savvy churches looking for customizable workflows to automate payroll, HR, and IT tasks

- MinistryWorks: Best for ministries requiring a dedicated payroll specialist who only works with churches

Top Church Payroll Services Compared

All the church payroll software on our list offer full-service payroll, tax filing services, W-2 and 1099 tax forms at year-end, and unlimited pay runs (except MinistryWorks). Apart from pricing, here are some of each provider’s standout features.

*Monthly fees are for SurePayroll’s full-service payroll plan with tax filing services

**Pricing is based on a quote we received; includes payroll, time tracking, and access to Rippling’s core workforce management platform.

Unsure which church payroll service is right for your business? This online quiz will help you decide.

Which Church Payroll Service is Right For You?

Answer a few questions about your church, and we’ll give you a personalized product match.

Gusto: Best Overall Church Payroll Service

Gusto

Overall Score: 4.23

OUT OF 5

What We Like

- Unlimited and automated pay runs

- Online portals for employee self-onboarding

- Integrates with several third-party software (like Aplos, Xero, Clover, and QuickBooks)

What’s Missing

- No dedicated payroll specialist

- Health benefits coverage limited to 39 states

- Time tracking included only in higher tiers

Gusto Pricing

- Simple: $40 per month + $6 per employee monthly:

- Includes full-service payroll, tax filings, payroll tax filings, single state pay processing, two- and four-day direct deposits, employee benefits, new hire reporting, offer letter templates, onboarding, and basic support

- Plus: $80 per month + $12 per employee monthly:

- Simple + next-day direct deposits, time and paid time off (PTO) tracking, applicant tracking, basic job postings, project tracking, and full support with extended support hours

- Premium: Custom-priced

- Plus + performance reviews, surveys, full-service payroll migration, access to HR experts, direct line to priority phone and email support, and a dedicated account manager

- Contractor-only plan: $6 per contractor monthly

- Full-service payroll, four-day direct deposits, and state new hire reporting

Add-ons

- State payroll tax registration: Pricing varies per state

- HR advisory services for Plus plan only: $8 per employee monthly (this is included for free in the Premium tier)

Gusto scored better than the other providers because it offers full-service payroll, tax compliance, and basic HR tools at a reasonable price. It also provides unlimited pay runs, automated taxes and forms, and state new hire reporting. Church employees are even granted access to a self-service portal to access and view pay information online.

The provider supports church payroll needs by allowing you to set up tax exemptions for the church and its ministers. In addition, it integrates well with Aplos, a nonprofit fund accounting software that automatically tracks payroll and tax payments for nonprofits and churches.

Overall, Gusto earned a score of 4.23 out of 5. It would have gotten higher scores had it not been for the limited coverage of its employee health benefits. Compared to providers like QuickBooks Payroll and SurePayroll, which have benefits available in all US states, Gusto’s health insurance options are limited to only 39 states as of this writing. It also doesn’t have a dedicated payroll specialist who can help double-check your pay runs, something MinistryWorks offers.

However, many users still raved about its ease of use, intuitive interface, and efficient payroll tools. On the other hand, some said that while it generally provides good customer service, contacting its support team can be a bit difficult at times.

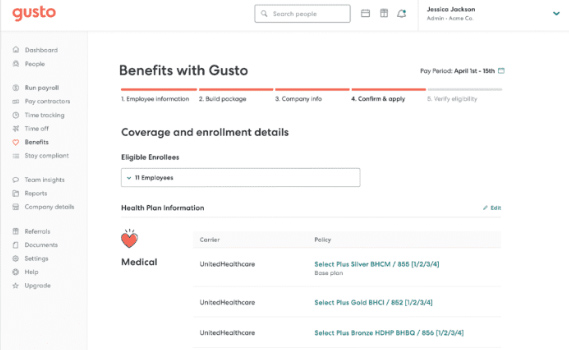

While Gusto can pay employees and process clergy-specific allowances, its benefits module can help track benefits plans and online enrollments.

(Source: Gusto)

Gusto Key Features

Efficient pay processing

In addition to automatic and unlimited pay runs, you can pay church employees via manual checks and direct deposits (two- and four-day options). It also offers next-day direct deposits—provided you subscribe to its higher tiers. But if you require faster direct deposits, QuickBooks Payroll is a great alternative, as it has a same-day option.

Tax payment and filing services

Depositing and filing payroll taxes won’t be a problem since Gusto handles that for you. Given that ministers may be exempt from certain taxes (like Medicare and Social Security), you can set up a church-specific tax exemption directly in the system. This is unlike Rippling, which doesn’t have built-in special codes for church payroll.

Employee benefits

With Gusto, you get a wide range of benefits options—health insurance, dental and vision, 401(k) plans, workers’ compensation, and a health reimbursement program. However, Gusto’s health insurance plans are unavailable in 11 states (Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, South Dakota, West Virginia, and Wyoming). If your business is in one of these states, consider any of the other providers in this guide.

Clergy housing allowance

Setting up a housing allowance for ministers and the clergy is easy with Gusto. You can even add the allowance amount as a recurring reimbursement.

Integration with Aplos

Gusto is the only church payroll software that we reviewed that connects seamlessly with Aplos, making it easy for you to track payroll and tax payments. It also integrates with several third-party solutions like QuickBooks, Xero, Homebase, and When I Work.

Custom reports

Aside from customizable reports, Gusto offers an online report builder that allows you to create your own reports directly from its system. Of the six church payroll services we reviewed, only Gusto and QuickBooks Payroll have this feature.

QuickBooks Payroll: Best for QuickBooks Users & Churches Wanting Fast Direct Deposit Options

QuickBooks Payroll

Overall Score: 4.09

OUT OF 5

What We Like

- Unlimited pay runs

- Next- and same-day direct deposits

- Health benefits cover all 50 US states

- Offers state new hire reporting via electronic form filings

What’s Missing

- Local tax payment and filing services available only in higher tiers

- Limited third-party integrations (mostly integrates with QuickBooks products); you need QuickBooks Accounting to integrate with other software

- Access to a personal HR adviser and 24/7 payroll support experts only included in its highest tier

- State new hire reporting is limited to states that accept e-form filings

QuickBooks Payroll Pricing

- Core: $45 per month + $5 per employee monthly

- Includes full-service payroll, next-day direct deposit, federal and state tax filings and payments, and access to 401(k) plans and benefits

- Premium: $75 per month + $8 per employee monthly

- Core + same-day direct deposit, local tax payments and filings, workers’ compensation administration, and HR support center

- Elite: $125 per month + $10 per employee monthly

- Premium + multiple state tax filing, project tracking, personal HR adviser, tax penalty protection up to 25k per year, and expert setup

QuickBooks Payroll is best for churches that handle their own bookkeeping using QuickBooks Online to seamlessly integrate their payroll information. Its church-specific features, like multiple pay types for housing allowances, also make it a good option. It offers unlimited payroll runs, and you can send direct deposits to your employees’ bank accounts within 24 hours. With its Premium and Elite plans, you can even send payroll funds on the same day.

While QuickBooks Payroll earned an overall score of 4.09 out of 5 in our evaluation, its rating was pulled down by a lack of in-house church payroll and tax experts (which MinistryWorks has) and the need to upgrade to its higher tiers for local payroll tax filing services. And unlike Gusto and Rippling, it doesn’t integrate with a lot of third-party software—you need QuickBooks Accounting to access its integration options.

Many users said it has a user-friendly platform that helps make pay processing easy. However, some users commented that while its customer representatives are helpful, the time it takes before they can chat or speak with someone is a bit long at times.

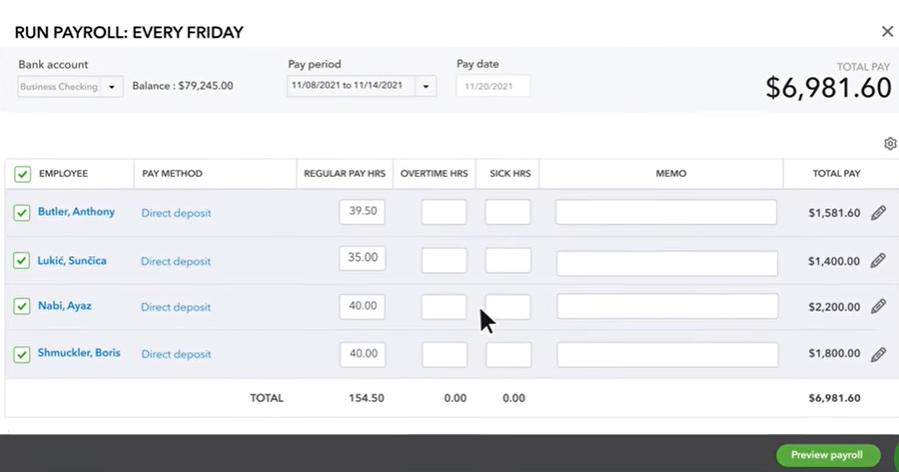

QuickBooks Payroll’s pay processing solution

(Source: QuickBooks Payroll)

QuickBooks Payroll Key Features

Fast direct deposits

Unlike the other church payroll services we reviewed in this guide, QuickBooks Payroll offers same-day direct deposits in addition to a next-day option (which is its standard direct deposit turnaround time). You do have to subscribe to its Premium or Elite plan to gain access to same-day payouts, though.

Efficient pay processing

QuickBooks Payroll provides automatic and unlimited pay runs at no extra cost. This is unlike MinistryWorks where you are charged for each payroll run. It lets you set up church-specific tax exemptions and clergy housing allowances and pays employees via direct deposits and paychecks.

Payroll tax filings

QuickBooks can handle payroll tax calculations and filings for federal and state, including end-of-year reports. While it calculates local taxes, it doesn’t file local tax forms unless you subscribe to its higher tiers. Of the six church payroll services we reviewed, only QuickBooks Payroll doesn’t include tax filings for all levels in its starter tier.

Employee benefits

Unlike Gusto’s health insurance plans, which cover only 39 states, QuickBooks Payroll’s employee benefits are available in all US states. However, if you’re looking for unique benefits like college savings plans and a health reimbursement option, consider Gusto.

Expert payroll support

Even with its basic Core plan, you are granted access to payroll support experts you can contact via phone and 24/7 chat if you require troubleshooting assistance and step-by-step help. Although, if you want support from clergy payroll experts, we recommend MinistryWorks, as it assigns a dedicated church payroll specialist to its clients.

Custom reports

In addition to customizable reporting, QuickBooks Payroll (like Gusto) lets you build and create your own reports directly from its system.

Read Our QuickBooks Payroll Review

OnPay: Best for Church Administrators Needing Robust System Permissions To Delegate Payroll & HR Tasks

OnPay

Overall Score: 3.79

OUT OF 5

What We Like

- Unlimited payroll

- Multiple payment options (like direct deposits, manual checks, and debit cards)

- Six-level system permissions allow you to delegate tasks and run payroll however you want

What’s Missing

- Lacks multiple tiers that cater to varying payroll and HR needs

- Doesn’t have live phone support during weekends (only email)

- Limited third-party software integrations

- Eligibility to two- or four-day direct deposits depend on OnPay’s risk assessment

OnPay Pricing

- $40 per month + $6 per employee monthly

- Includes payroll processing, multiple payment options, payroll tax management, onboarding and new hire reporting, PTO management, employee benefits, self-service portal, reporting tools, and third-party integrations

- Add-ons

- Access to live HR experts (via Mineral HR): $20

- W-2/1099 printing and mailing services: $5 per form, which is free if you print the online forms yourself

- Nonsufficient fund (NSF) return fee*: $50 per returned item

*OnPay charges an NSF fee in case your payroll fund isn’t sufficient to cover the cost of a pay run.

OnPay has six levels of system permissions, allowing you to run payroll however you want and delegate payroll and HR tasks. You can even select which solutions (such as online forms and PTO filings) your clergy and non-clergy employees have access to. Apart from full-service payroll, you get unlimited pay runs and access to health benefits across all US states (Gusto’s is limited to 39 states). It also helps ministries calculate correct payments for clergy staff by excluding federal unemployment taxes from church payroll computations.

In our evaluation, OnPay earned an overall score of 3.79 out of 5, with high points (4 and up) in HR features, reporting capabilities, payroll functionalities, and pricing. It would have ranked higher on our list if its church-specific tools included integrations with third-party church accounting and church management software. While it offers access to HR advisers through its partner, Mineral HR, you have to pay extra for it ($20 monthly for contacting an HR expert).

In terms of user feedback, those who left online reviews on third-party sites like G2 and Capterra highlighted its ease of use and responsive support team as its best features. Some, however, complained about its limited PTO customization and software integration options.

OnPay’s payroll tool has expandable columns and summaries, allowing you to take a closer look at itemized wage breakdowns, taxes, and deductions.

(Source: OnPay)

OnPay Key Features

Unlimited payroll runs

With OnPay, you can run payroll for both non-clergy and clergy employees as many times as you need in a month without having to pay extra. Your clergy and non-clergy staff can get their wages through debit cards, paychecks, and direct deposits—although you have to undergo OnPay’s risk assessment to determine whether you can pay via two- or four-day direct deposits. Note that the other church payroll services we reviewed don’t have this requirement.

Payroll tax payments and filings

OnPay automatically calculates and withholds payroll taxes for your non-clergy workers. It even remits payments and submits quarterly and year-end forms to the applicable tax agencies. For your clergy employees, it can handle church-specific tax exemptions and automatically excludes Social Security, Medicare, and federal unemployment tax computations from payroll runs.

Essential HR tools

Apart from automated workflows to streamline online onboarding, it files state new hire reports for you and can help you manage PTO balances and accruals. Robust system permissions also allow you to control HR and payroll access, as well as delegate tasks.

Employee benefits

Unlike Gusto’s health insurance, which covers only 39 states (as of this writing), OnPay’s health plans are available in all US states. Your employees are granted access to dental, vision, disability, and retirement plans. You can also choose and compare benefits packages from several major providers, such as Aetna, Human, and United Healthcare.

SurePayroll: Best for Small Churches Wanting Budget-friendly Payroll Plans With DIY Tax Filings & Full-service Options

SurePayroll

Overall Score: 3.68

OUT OF 5

What We Like

- Flexible payroll plans with a DIY tax filing option

- Unlimited and automatic pay runs

- Affordably priced

What’s Missing

- Charges add-on fees for multiple state and Ohio/Pennsylvania local tax filings

- Software integrations cost extra; with limited options

SurePayroll Pricing

- “No Tax Filing” plan: $19.99 monthly + $4 per employee

- Includes payroll and payroll tax calculations, four-day direct deposits, unlimited and automatic pay runs, new hire reporting, and online pay stubs

- Full-service package: $29.99 monthly + $5 per employee

- “No Tax Filing” features + two-day direct deposits and payroll tax filing services

What makes SurePayroll a good option for small ministries is its budget-friendly and flexible payroll options. This includes a full-service payroll package (costing $29.99 plus $5 per employee monthly) with access to employee benefits plans and automatic tax payments and filings. It also has a payroll plan that doesn’t include tax filing services (priced at $19.99 plus $4 per employee monthly)—ideal for those who prefer to save money remitting tax payments and submitting tax forms themselves.

In our evaluation, SurePayroll earned an overall score of 3.68 out of 5. While it posted ratings of 4 and up in reporting capabilities, HR features, and pricing, it scored poorly in church-specific functionalities primarily because it doesn’t assign church payroll advisers who can offer expert advice (MinistryWorks provides this service). And although many users posted positive reviews online about its user-friendly system and efficient payroll tools, it posted low scores in our popularity criterion, given that its number of average reviews on G2 and Capterra is fewer than 500.

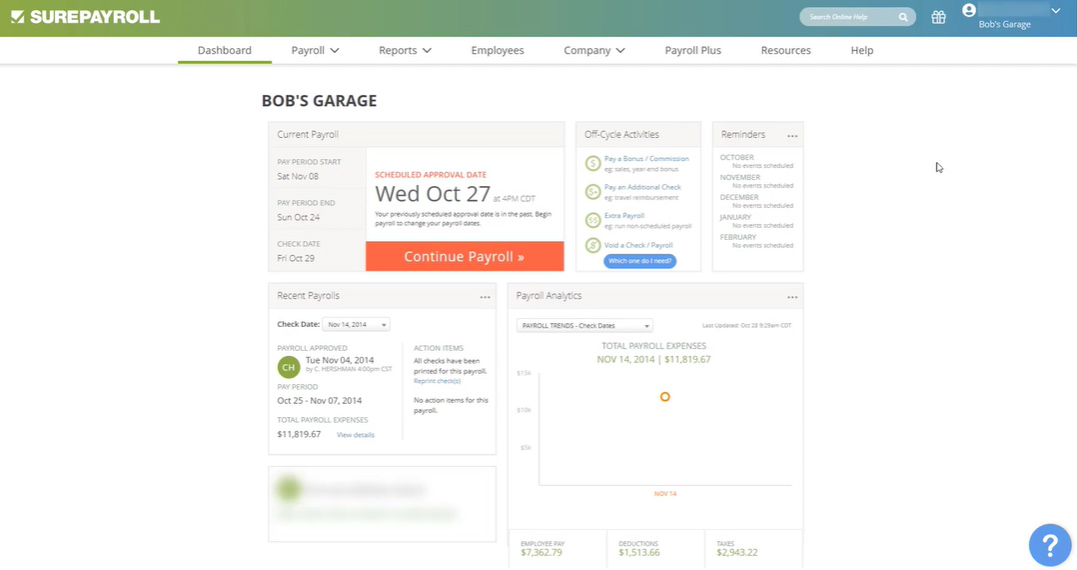

SurePayroll’s main dashboard contains links to running payroll and off-cycle payments, including payroll analytics and helpful reminders.

(Source: SurePayroll)

SurePayroll Key Features

Payroll processing

Similar to Gusto and QuickBooks Payroll, you get automatic and unlimited pay runs with SurePayroll. It calculates salaries and deductions for both clergy and non-clergy employees. It also supports church-related allowance payments, and it helps keep you up-to-date with the Clergy Housing Allowance Clarification Act regulations.

Payroll tax filings

While “No Tax Filing” plan holders have to handle tax payments and filings on their own, those on its full-service package don’t have to worry about remitting and filing payroll taxes—SurePayroll handles this for them. Its online church payroll services also ensure that you follow specific tax requirements when processing payments for clergy employees.

Employee benefits

SurePayroll has a wide range of affordable benefits options that include retirement, health insurance, and pay-as-you-go workers’ compensation plans. While it lacks Gusto’s college plan savings, the coverage of its health plans is more extensive than Gusto’s (50 states vs 39 states).

Third-party software integrations

While it doesn’t have Rippling’s robust integration options, SurePayroll connects with accounting and time clock software that most small businesses use. These include QuickBooks, Xero, stratustime, Buddy Punch, Homebase, and TimeForge. However, unlike the other church payroll providers on this list, you have to pay extra for software integrations.

Rippling: Best for Tech-savvy Churches Wanting to Automate Payroll, HR & IT Tasks

Rippling

Overall Score: 3.61

OUT OF 5

What We Like

- Modular HR, payroll, and IT solutions integrate seamlessly with each other

- Connects with 500+ business apps

- IT tools help streamline computer/app provisioning and deprovisioning processes

What’s Missing

- Its core workforce management solution must be purchased before adding other modules

- Gets pricey as you add features

- Phone support from HR experts costs extra

Rippling Pricing*

- $35 plus $8 per employee monthly

- Includes Rippling’s core workforce management platform, employee onboarding and offboarding, full-service payroll, time tracking, and software integrations

Other Per-Module Costs*

- App, device, and computer inventory management: $5 per employee monthly

- Includes IT tools to manage business apps and computer provisioning and deprovisioning processes

- Benefits administration: Pricing varies, depending on your insurance broker

- HR help desk: Custom-priced

- One-on-one email/phone support from HR experts

*Pricing is based on a quote we received

What makes Rippling a good option for churches is its all-in-one solution that not only streamlines HR and payroll processes but also automates basic IT tasks—from monitoring computer inventory to managing business software and assigning laptops to personnel. This allows you to focus more on running your ministry and less on handling day-to-day HR administrative processes.

Rippling scored 3.64 out of 5 in our evaluation, with ratings of four and up in nearly all of our criteria. Users also appreciate its intuitive and feature-rich platform. However, it posted low scores in ease of use and church-specific features mainly because its live phone support from HR advisers is a paid add-on, and it lacks built-in special church payroll codes (although it can handle tax exemptions for clergy employee payments). It also doesn’t assign dedicated church payroll specialists to its clients like MinistryWorks does.

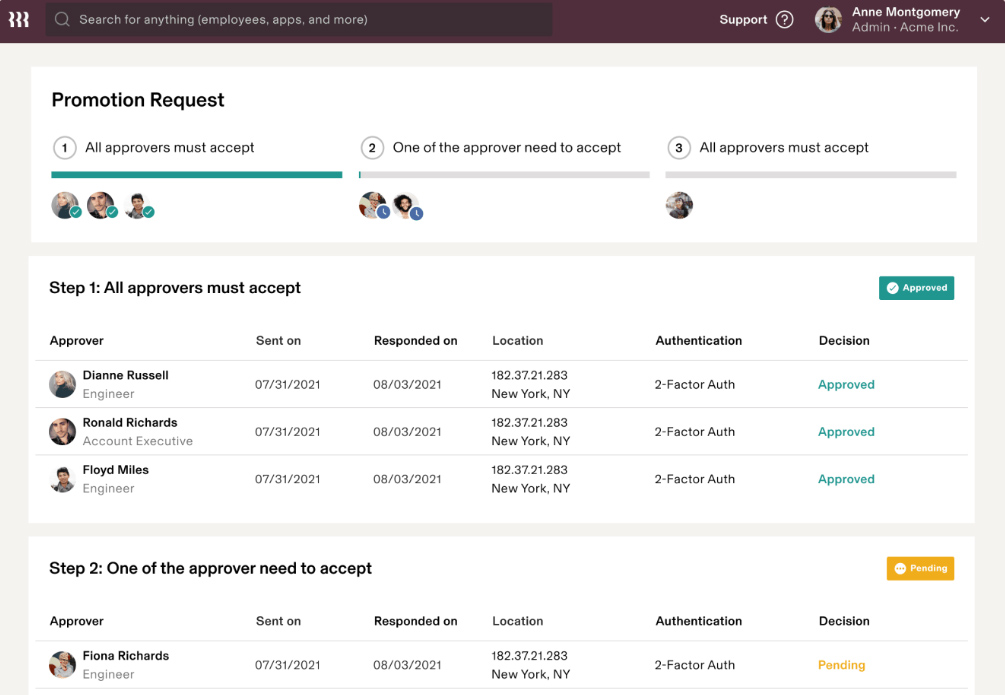

Rippling’s robust automation tools allow you to create simple to complex workflows to manage online approvals and automate HR tasks.

(Source: Rippling)

Rippling Key Features

Integrated modular solutions

Rippling has a modular system with a suite of comprehensive solutions that integrate well with each other. This means that information (such as employee and salary details) flow seamlessly between modules, eliminating potential errors from manual data entries. However, you have to purchase its workforce management platform (its core system) before you can add other modules like employee benefits, time tracking, and payroll.

Full-service payroll

Rippling makes processing employee payments easy for payroll administrators. You can even run payroll with just three clicks. Apart from automatically calculating wages and the applicable tax deductions for both clergy and non-clergy employees, it files payroll forms for you.

Robust HR tools

Rippling has a wide range of HR solutions for managing employee information, benefits, time and attendance, training programs, job postings, and hiring. However, these modules are paid add-ons to Rippling’s core workforce management platform. This can make Rippling an expensive option for small ministries, especially if church administrators will get all of its features. If these solutions are important to you, consider Gusto, as it offers similar functionalities at more reasonable rates (monthly fees start at $40 plus $6 per employee).

IT solutions

With Rippling’s IT tools, you can streamline and automate device and app management processes. It helps you assign computer units and identify business apps that employees need. It also disables your resigning staff’s access to company-assigned computers and business software on their last working day. Rippling can even manage your computer inventory and store unused units in its warehouse for you. Gusto may have similar IT provisioning and deprovisioning tools, but these are limited compared to Rippling. The four other church payroll services we reviewed don’t have IT solutions.

Workforce automation tools

While OnPay offers six levels of system permissions to control access and delegate tasks, Rippling has robust workforce automation tools to automate and simplify HR, payroll, and IT processes. It even provides ready-to-use workflow templates, but you can easily create your own—no coding knowledge needed.

MinistryWorks: Best for Ministries Needing a Dedicated Payroll Specialist Who Only Works With Churches

MinistryWorks

Overall Score: 3.54

OUT OF 5

What We Like

- Automated payroll and tax filings

- Files state new hire reports

- Access to a dedicated payroll specialist

What’s Missing

- Charges per pay run

- Limited benefits options

- Very few third-party software integrations

MinistryWorks Pricing*

- Weekly payroll: $9.58 per pay run

- Biweekly payroll: $12.65 per pay run

- Twice monthly payroll: $13.17 per pay run

- Monthly payroll: $19.83 per pay run

All plans include payroll and tax calculations, payroll tax filings, direct deposits, and access to a dedicated payroll specialist.

*Pricing is from MinistryWorks’ online calculator that shows estimated fees for one employee and for different payroll frequencies. Contact the provider to request a quote.

MinistryWorks is a church payroll software specializing in clergy and ministry tax law. It runs payroll, pays your employees via checks and direct deposits, and handles all federal, state, and local tax filings. In addition to Affordable Care Act (ACA) reporting, it manages tax withholdings and deductions and even provides you with a dedicated payroll specialist.

Overall, it earned a score of 3.54 out of 5 in our evaluation. MinistryWorks didn’t score as highly as Gusto and QuickBooks Payroll because it doesn’t offer unlimited pay runs, quick direct deposits, or a report builder for creating custom reports—all important features for churches running payroll. It also has limited integration options with third-party software, and the number of up-to-date user reviews available online is slim. However, users appreciate that its software is easy to use and its dedicated payroll specialists are responsive and helpful.

MinistryWorks Key Features

Efficient pay processing

With MinistryWorks, you are granted access to church payroll services designed to handle the pay processing and tax calculation needs of ministries. It offers automatic payroll runs, and you can pay employees via manual checks and direct deposits. It does not, however, provide same-day direct deposits as QuickBooks Payroll does. If you want to run payroll as many times as you need without having to pay extra, we recommend any of the other providers included in our guide, all of which offer unlimited pay runs.

Tax filing services

MinistryWorks handles federal, state, and local payroll tax filings, including year-end tax reporting. You also get tax law compliance counseling and workers’ compensation audit assistance.

Employee benefits

In addition to pay-as-you-go workers’ compensation and clergy housing allowances, MinistryWorks offers health care reporting and employee eligibility status tracking. However, if you’re looking for more benefits options, consider QuickBooks Payroll and Rippling (although you have to purchase two add-on benefits modules with Rippling). Gusto is also a good alternative, but its health insurance plans aren’t available in all US states.

Dedicated payroll support

QuickBooks may include expert payroll support even in its basic Core plan, but MinistryWorks provides a personal payroll specialist who can help review and check pay runs for all of its clients. Note that SurePayroll, Rippling, and OnPay don’t offer this service, while Gusto includes this service only in its premium plans.

How We Evaluated the Top Church Payroll Services

We compared 14 payroll providers that offer church payroll software, looking for functionalities we believe are most important for churches and ministries. These features include payroll and tax management tools specific to church payroll, plus attributes that make the service easy to use. We also considered providers that offer flexible pricing options affordable for small businesses.

Click through the tabs in the box below to view our full evaluation criteria.

15%

Church-specific features

20% of Overall Score

We gave priority to those that offer automatic payroll runs, direct deposit with an option to process paper checks, and access to tax payment and filing, including year-end forms filing (W-2s and 1099s). Most of the payroll providers we reviewed earned 4 and above ratings in this criterion except for SurePayroll (you have to pay extra for local tax filings in Ohio and Pennsylvania—provided you’re on its Full Service plan).

20% of Overall Score

We looked at the monthly implementation costs, processing costs, and set-up and year-end fees. Preference was given to providers that are affordable since churches and ministries are not-for-profit organizations. Gusto, SurePayroll, and QuickBooks Payroll scored perfect marks in this criterion.

20% of Overall Score

Payroll service and software should be easy to access and simple to set up and have a user-friendly interface. A dedicated representative, as well as employer ID and tax set-up assistance, are top criteria. Sometimes, churches are on the lookout for HR advising and online resources or how-to guides. All of the six church payroll software we reviewed have online tools that are easy to learn, but if you want a dedicated church payroll specialist, consider MinistryWorks.

15% of Overall Score

We gave priority to church payroll services that have expertise in the unique tax treatment of clergy housing allowances and tax exemptions. We also looked into providers that integrate well with existing church accounting systems and/or time clocks. MinistryWorks scored the highest here.

10% of Overall Score

10% of Overall Score

We considered user reviews, including those of our competitors, based on a 5-star scale; any option with an average of 4+ stars is ideal. Also, any software with 1,000+ reviews on any third-party site is preferred. We also searched for reviews left specifically by churches. The providers that didn’t get a perfect score here include OnPay, SurePayroll, QuickBooks Payroll (these three providers have fewer than 1,000 reviews), and MinistryWorks (it doesn’t have user reviews on online sites like G2 and Capterra as of this writing).

5% of Overall Score

Software with standard payroll reports is considered robust, as well as those that are customizable and/or have functionality allowing users to build their own reports. All of the six church payroll software we reviewed offer standard payroll reports and report customization options.

*Percentages of overall score

Bottom Line

Churches and ministries have more complicated requirements than general small businesses and need access to clergy tax law and church payroll practice expertise. Depending on your budget, there are different church payroll services to choose from. Apart from affordability, the best church payroll software should have features that help ministries pay clergy and non-clergy employees efficiently and, at the same time, be tax compliant.

We found that Gusto offers all of the features churches would need to facilitate their payroll and tax compliance needs. It’s easy to use and handles tax filings for you, and the price is reasonable when compared to other church payroll services. Sign up for a free trial today.

https://www.cupbord.com/6-best-church-payroll-services-for-2022/

Leave a Reply