5.

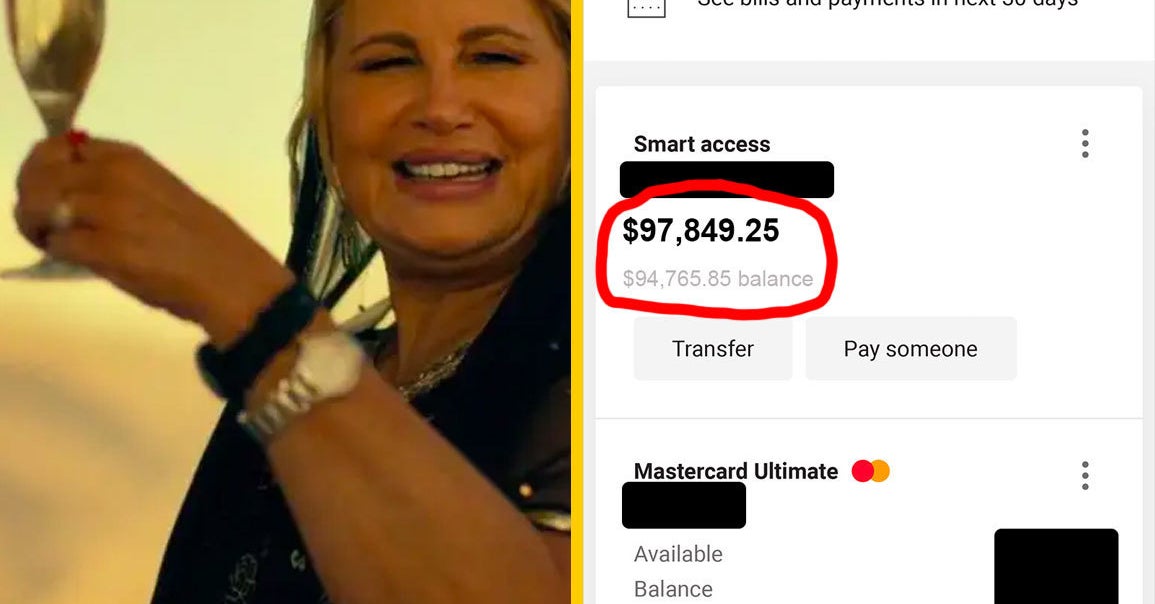

Couple, 51, semi-retired, $130K in savings,

“Married, own our own home worth around $1.3m (no mortgage). $130K in the bank and $700K in super. When we were earning two incomes, we lived off one income and the other went straight into the mortgage. Salary sacrificed into super as well and made lump-sum contributions if either of us got a bonus.

One income went into an offset account, and the other went into the mortgage — we were effectively paying almost double on our mortgage payments, while offsetting the whole thing.

We’d also regularly ‘trade up’ on our property — we’d renovate and then look for another home in a good area that needed a little work. Not too much, but enough to increase its value. We’d ensure that the mortgage was about the same that we were already paying.

We’d purchase that property, do it up a little, then sell again after about five years to ensure that the value had gone up sufficiently.

That said, we have no kids, don’t smoke, don’t wear ‘designer’ clothes, and only have one vehicle — we purchase our vehicles outright, so we have no outstanding debt.

We still manage to socialise well though and often have friends to our home to entertain — we’re not social outcasts, we just don’t squander our money on stupid shit.

We don’t have the latest phones, the only membership we have is a gym membership, not extravagant shoppers, don’t take yearly overseas holidays etc.

Now, we can afford to relax and wind-back a bit — go part-time with work, semi-retire early and enjoy our money while we’re still relatively young.”

—u/Inconnu2020

Source link

Leave a Reply