The best bookkeeping service for you is the one that fits your budget, allows you to be as involved as you want to be, and meets your expectations for communication. To compare Bench vs Merritt Bookkeeping, consider your business needs. Bench provides a broader variety of services besides bookkeeping, while Merritt Bookkeeping offers a flat rate for basic bookkeeping services―no matter the size of your business.

When To Use Each

- Businesses that need unlimited bookkeeping support: Bench provides you with unlimited and direct communication with its in-house research team, making it easy for you to receive bookkeeping support and guidance.

- Small business owners who want tax advice and preparation: Because Bench offers a one-stop shop for bookkeeping services, you can combine tax services with the monthly bookkeeping services. If you enroll in the Premium plan, an annual business tax return is included.

- Businesses that don’t want to purchase or learn accounting software: Signing up for Bench gives you access to a team of professional bookkeepers who will manage your books for you, eliminating the need to purchase your own accounting software.

- Businesses that have fallen more than two years behind in their bookkeeping: BenchRetro, one of Bench’s add-on services, is a great solution if you have overdue books and tax deadlines approaching. While Merritt Bookkeeping also offers catch-up bookkeeping, users might find Bench’s interface more intuitive.

- Businesses on a budget: Merritt Bookkeeping offers a flat rate for basic bookkeeping services that is affordable and a great choice for freelancers and independent contractors.

- Businesses that only want to track income and expenses for their tax returns: If you just plan to use your financial statements to prepare your tax return, but not to manage your business on a regular basis, then Merritt Bookkeeping’s services are a good fit for you.

- Small businesses that need to file 1099s: If you don’t have employees and, instead, work with contractors, Merritt Bookkeeping’s 1099 filing is included for an additional fee of $75 for report preparation and $8 per form.

- Businesses that don’t want a steep software learning curve: Because Merritt Bookkeeping’s clients use a client portal that links to summary reports, you never have to worry about accessing the software yourself.

When to Choose a Different Online Bookkeeper

There are situations where another online bookkeeping service may be a better fit for your business.

- QuickBooks Online users: While Merritt Bookkeeping prepares your books using a QuickBooks Online account, you aren’t allowed to directly access it. Thus, if you need to issue invoices and track unpaid bills, you will need to use a separate software. QuickBooks Live is the best solution for QuickBooks Online users, with many useful features that will streamline the process.

- Businesses with plans scale soon or that need to switch providers: If you have a standard plan with Bench, you are limited to the number of financial accounts that you can connect to your books. It also operates on proprietary software that doesn’t sync with accounting programs like QuickBooks Online. Consider Pilot if you’re looking for a solution that will scale quickly.

- Businesses that need financial planning and advice: Neither Bench nor Merritt Bookkeeping offers financial planning services like investment and business expansion. If you’re looking for an all-in-one bookkeeping provider that offers financial planning and advice, try Bookkeeper360.

For more information about the different types of assisted bookkeeping available for small businesses, check out our evaluation of the best online bookkeeping services. If you’re looking for other alternatives, see our roundup of the leading small business accounting software.

Bench vs Merritt Bookkeeping at a Glance

*Price is based on signing an annual contract. If you don’t sign, the price goes up to $349.

**Annual contract required.

Bench vs Merritt Bookkeeping: Pricing

- Bench offers two plans at $249 or $399 per month and add-on services for a fee

- Merritt Bookkeeping charges a flat rate of $190 per month

So, if you would like to select from a more extensive menu of services with the ability to add on features as needed, go with Bench. But if you’re looking for a no-frills service that offers basic bookkeeping, then Merritt Bookkeeping is the better solution.

Both of Bench’s plans include monthly bookkeeping and year-end reporting, but the higher tier offers more features, such as unlimited federal and state tax filings and tax advisory services. Bench even has several add-ons, such as invoicing (A/R) and bill payment (A/P), which are available with its specialized bookkeeping package, which starts at $100 per month.

Meanwhile, Merritt Bookkeeping’s pricing is very straightforward: a flat rate of $190 per month—regardless of the size of your business and the numbers of transactions, accounts, monthly expenses, and employees. You can also opt for its catch-up bookkeeping services, which run from $70 to $140 per month, depending on the number of transactions that must be entered.

You can learn more about their pricing by reading our Bench review and Merritt Bookkeeping review.

Bench vs Merritt Bookkeeping: Features

Bench offers various services besides basic bookkeeping, including tax preparation and filing. In contrast, Merritt Bookkeeping only offers basic bookkeeping, with no ability to customize any additional services. However, if you want to save money, it’s the better option, especially since it costs the same, regardless of your number of employees and monthly transactions.

Bench goes beyond bookkeeping services, with a full menu that includes tax support and specialized bookkeeping. Its mobile app even lets you streamline communication with your dedicated bookkeeper and upload bills or receipts. For more information about the available features, check out our in-depth Bench review.

Meanwhile, Merritt Bookkeeping is a good option if you want to be more hands-off with your bookkeeping. Your bookkeeper will set up your accounts for you and handle categorizing your transactions. You can access your file through the client portal, which is also how you’ll interact with your bookkeeper, who will send you basic financial reports monthly. Read our comprehensive Merritt Bookkeeping review to learn more about its features.

Bench vs Merritt Bookkeeping: Working With Your Bookkeeper

Both Bench and Merritt Bookkeeping assign you to a dedicated bookkeeper upon enrollment. Merritt Bookkeeping outsources the work to overseas contractors while Bench uses its own employees.

Hence, if you want a more extensive level of contact, Bench is a good option. But if you want limited involvement and hand-off management of your books to a bookkeeper, consider Merritt Bookkeeping. However, while both allow you to communicate via a client portal, neither allow direct access to your file, and contact is limited with Merritt Bookkeeping.

Bench: Working With Your Bookkeeper

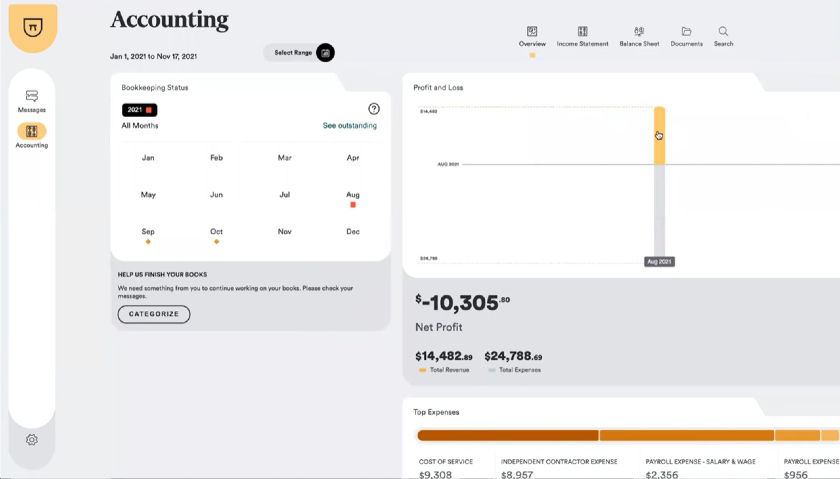

Once you enroll with Bench, you’ll be assigned a team of three dedicated bookkeepers, one of which will be your account manager. They’ll learn more about your business and assist you with customizing your account to ensure accurate expense tracking. They’ll also help you to connect your bank and merchant accounts so that read-only data will be imported into your Bench account automatically.

You’ll receive monthly financial statements from your bookkeeper, plus a year-end financial package, which includes all of the necessary information for your accountant to file your taxes. To access your financial information, you need to log onto your account on the Bench website. You can also communicate with your bookkeeper via the mobile app, email, or direct message on the Bench website.

Bench’s proprietary software allows you to track income and expenses, and you’ll find that it’s both intuitive and user-friendly. Both you and your bookkeeper can leave notes on transactions, ultimately saving time. Bench’s historical bookkeeping services let you pass on months or years of mismanaged books and recover missing documents to get you back on track. This can be beneficial if you need supporting documents to apply for loans.

Onboarding process with Bench

(Source: Bench Accounting)

Merritt Bookkeeping: Working With Your Bookkeeper

While Merritt Bookkeeping is run by a small team in San Diego, it outsources the actual bookkeeping to several overseas contractors. The San Diego team serves as the point of contact, providing quality control and answering any questions that may come up. You can also reach your assigned bookkeeper by email or phone during regular business hours.

Once you enroll with Merritt Bookkeeping, an employee will assist you with setting up your bank and merchant accounts. You’ll be assigned your own dedicated bookkeeper who’ll manage your finances with QuickBooks Online, which will import read-only versions of your bank statements using LedgerSync, a free third-party software. If you don’t already have a QuickBooks file, Merritt Bookkeeping will create one for you, but you won’t have personal access to your QuickBooks file.

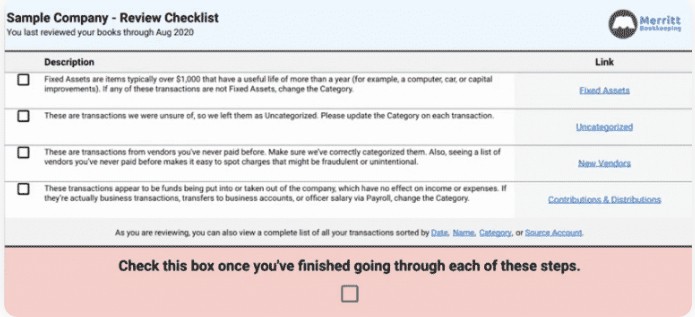

Your bookkeeper will categorize your transactions based on the chart of accounts, reconcile your QuickBooks file with the bank statements, and send you PDF reports of your financial data on a monthly basis. After set-up, contact will be limited. You’ll receive a link to your dashboard each month that gives you access to your financial reports, transaction details, and links to the support center. If you spot any inaccuracies, type them into the sheet and they’ll be updated.

Example of Merritt Bookkeeping’s review checklist

(Source: Merritt Bookkeeping)

Bottom Line

If you want to save money and are looking for basic bookkeeping services at an affordable rate, then Merritt Bookkeeping is a good option. However, if you prefer the ability to add services such as tax filing and invoicing clients, then Bench is the best choice. Your bookkeeping needs, such as whether you want to be able to invoice customers or pay bills, are an important factor to consider when evaluating your options.

https://www.cupbord.com/bench-accounting-vs-merritt-bookkeeping-2022-comparison/

Leave a Reply