Hewlett Packard Enterprise Co. invited a number of industry analysts to participate in HPE GreenLake Storage Day April 4. Notably, HPE declared 2023 the year of storage. Although the company made several storage-related announcements, perhaps even more interesting was what the event tells us about HPE’s culture, its strategy and the future direction of the company.

In this Breaking Analysis, we’ll share our takeaways from HPE’s event, held in Houston Texas, which included attendance at Chief Executive Antonio Neri’s quarterly all-hands meeting. We’ll try to emphasize areas that have not necessarily been the focus of most press and industry analyst writeups to date. We’ll also take a look at the latest Enterprise Technology Research survey data to put HPE’s market position in context across several of its major segments.

HPE’s new digs: a hip vibe in steamy Houston

HPE’s Houston headquarters were a pleasant surprise for someone who has never visited the facility. Remember after the split from Hewlett-Packard Co. HPE did a brief stint in San Jose, then moved its headquarters to Houston, ending a presence in Silicon Valley that spanned an incredible 10 decades.

HPE’s new headquarters make a statement.

Starting in the upper left of this photo collage, one enters the building to find a raised stage, a band with bright colors behind them, which doubled as a big screen. Squint through the shaded windows and there’s a giant stadium-sized screen that also carried the live event. We were then taken up to the second floor and greeted by a Mercedes Formula 1 car, and when we headed back down to the main stage, it was a house full of mostly HPE employees with seating for about 25 to 30 industry analysts.

In the lower right is Bobby Ford, HPE’s chief information security officer, at the news desk interviewing Antonio Neri. Before Neri came out, Ford warmed up the audience with a comedy routine that was actually pretty hilarious. Antonio reviewed some milestones in the quarter, emphasizing (again) the focused strategy of edge to cloud and everything-as-a-service.

Moving to the bottom middle that’s Casey Taylor, chief operating officer of HPE Storage, interviewing Tom Black, the executive vice president and general manager of HPE Storage, talking about the announcement, and on the bottom left Casey interviewing the chief information officer of the Dallas Cowboys.

This was a highly produced, upbeat, music-infused event and evidently is a quarterly occurrence at HPE. The audience of mostly employees was engaged, many beaming with pride.

Listen to a short clip of the vibe.

Did you see notice the applause sign? At any rate, not the kind of thing you’d historically expect from Hewlett-Packard. We were told that Neri had a heavy hand in the design of the building down to the smallest detail.

Why did we start here today? Because we’ve been witnessing a new excitement from HPE employees in our post-COVID face to face interactions and we weren’t sure how genuine it was. But this is real. Culture starts at the top. Antonio Neri has been transforming HPE and it showed this week.

HPE is diversifying a server-led business

We’ll get into some of the storage announcement and our take, but it has been widely covered in the press. We’ll put some links in our podcast show notes if you want to dig into the speeds and feeds. Instead, what we want to do today is to zoom out and take a broader look at HPE and what the storage announcement means more generally.

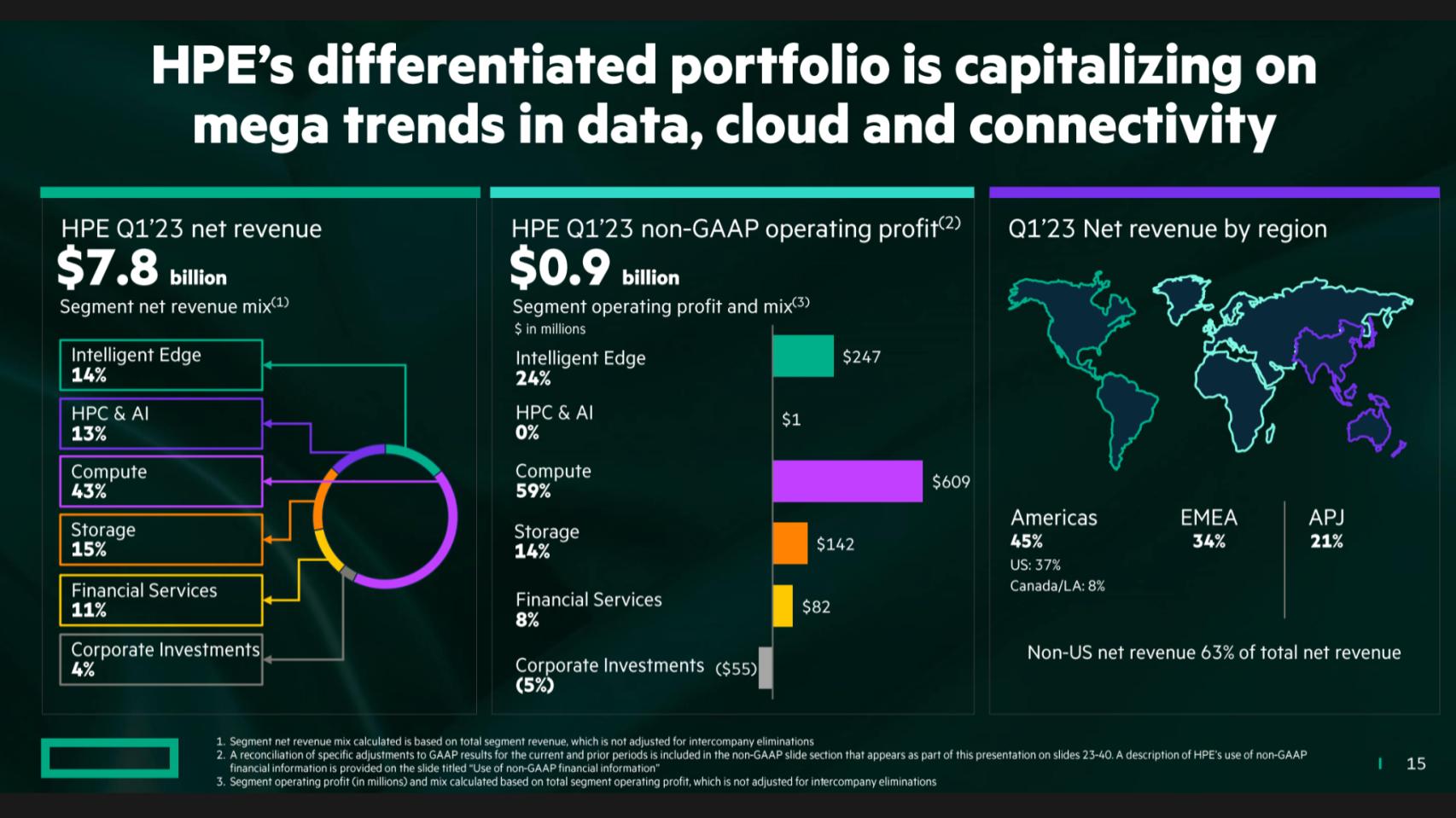

Above is a chart from HPE’s quarterly investor deck that breaks down its business. HPE does about $30 billion in revenue annually and has about a $20 billion market cap. It is most often compared to Dell Technologies Inc., which is a $100 billion revenue company with a $30 billion valuation. Of course Dell competes with both parts of the old HP, HP Inc. and HPE.

Historically, what is now the HPE portion of Hewlett-Packard mainly generated revenue from selling server boxes. For years the company has been trying to diversify and, through a series of acquisitions, some organic R&D and partnerships, it is now has a clear path toward that goal.

Above on the left, compute comprises by far the largest portion of HPE’s business. Storage at 15% of revenue was the focus this past week, for good reason. Storage is a higher gross margin business than compute and a stronger storage mix means more profits. It’s also strategic in that it comprises the infrastructure for data management.

Intelligent Edge is powered by the Aruba acquisition, which has been a home run for HPE and interestingly is a fundamental part of its storage offering. High-performance computing and artificial intelligence make up about 13% of revenue but don’t throw off any meaningful operating profit, as you can see in the middle portion of the chart.

Look at compute’s contribution to profits. It accounts for 59% of HPE’s operating profit. The operating profit contribution from storage is less than the revenue contribution, which is absolutely not the case for Dell. Independent storage companies such as Pure Storage Inc. and NetApp Inc. consistently have gross margins in the mid- to high 60s. Storage is simply a better business from a margin standpoint because most of the value add stays with the storage supplier. In servers, central processing unit, graphics processing unit and other semiconductor content comprise the bulk of value, leaving less for the server manufacturer. In storage, vendors can get paid for the software that controls I/O, manages performance and protects, compresses, copies and moves data.

Intelligent Edge (aka Aruba) is a 25%-plus growth business with 20%-plus operating profits. Its contribution to operating profit is higher than its revenue contribution.

Why HPE’s mid-30s gross margin has upside

Here’s what’s happening, and this started back when Meg Whitman was CEO. HPE is a server-centric company. And if you’re in servers, you’re not only battling Dell, you’re fighting the ODMs, the original design manufacturers such as Quanta Computer Inc. And the cloud is sucking up a lot of compute demand and budget.

So what do you do in an environment where Intel Corp., Advanced Micro Devices Inc. and Nvidia Corp. have gross margins significantly higher than the likes of HPE? Well — and this is something that Antonio Neri picked up from Meg and essentially had to force on his GMs — you create a set of standard and common components across your product lines to simplify, lower your costs and accelerate time to market. And you add software content on top with value-added features to get margins up. You create a cost-effective set of horizontal capabilities and drive that into your product lines wherever possible.

This is not rocket science and it’s not unique in the industry – everyone is doing this – but it’s culturally hard to do because a profit-and-loss leader might see an opportunity based on customer feedback to purpose-build a capability that is unique and can add special value in a sector. And the allure of doing so to compete is high.

This became clear in HPE’s storage announcements this week.

Horizontal leverage, add value to servers and the promise of HPC

When you squint through the marketing, two things were clear at Storage Day that we want to emphasize: 1) Part of HPE’s strategy is to take advantage of Aruba, add software on top of common components in servers and drive this across its line of products; and 2) HPE has a unique opportunity in HPC and AI, but it’s unclear which path it will take to get that business to be profitable.

Below are a couple of tells we uncovered from recent HPE executive statements.

HPE’s top server exec, CUBE alum Neil MacDonald, had this to say at investor day last year:

We’ve done phenomenally well with compute. If you look at the profitability of our compute business and our nearest competitor Dell, we from a margin standpoint make more money in compute than they do across compute, storage and networking taken together.

Now what Neil says is true. HPEs operating profit in compute is in the high teens – call it 19%. Dell’s operating profit in its ISG segment, which includes servers, networking and storage is around 12% to 13%. BUT Dell’s absolute operating profits in the segment are more than double HPE’s combined compute, networking and storage operating profits. So which is the better business? Would you rather have a smaller, higher-margin business or a bigger, lower-margin business that throws off more cash?

The real point, however, is HPE sees upside to its infrastructure margins in large part because of its ability to drive networking content into its product lines. As we’ve been reported in our Does Hardware Matter research, the systems world is increasingly becoming connect-centric versus its historical processor centricity.

Systems design is moving from a processor-centric world to one that is connect-centric where connections across the components surrounding the processor increasingly will determine price performance. This trend favors HPE Aruba.

Coming back to the executive quotes above, on HPE’s last earnings call Neri dropped this nugget:

We are assessing the type of business model we can deploy as a part of our as-a-service model. By offering what I call a cloud supercomputing IaaS layer with a platform-as-a-service….

He said on that same call that though he couldn’t mention the cloud company, one of the clouds is using HPE’s Cray supercomputing products for its HPC offering. He allows us to infer it’s one of the hyperscalers. Hopefully he’s not talking about non-hyperscalers. It wouldn’t be IBM Corp., since HPE licenses GPFS from IBM and IBM has Power and Quantum. Our guess is he’s talking about Microsoft Corp., so maybe there’s something in the works there? We don’t know, but that’s something to watch – this supercomputing infrastructure-as-a-service layer. HPE already has HPC running in GreenLake, so maybe Neri is talking about incremental enhancement there. Or maybe something more radical. We don’t know.

We do know that he talks quite a bit about generative AI and that supercomputing and AI are colliding. Foundation models such as GPT need a lot of compute power. In fact, let’s face it, despite HPE’s claim that 2023 is the year of storage… 2023 is the year of GPT.

Regardless, observers should be paying attention to HPE’s moves in supercomputing.

How large is the opportunity for a legacy infrastructure player?

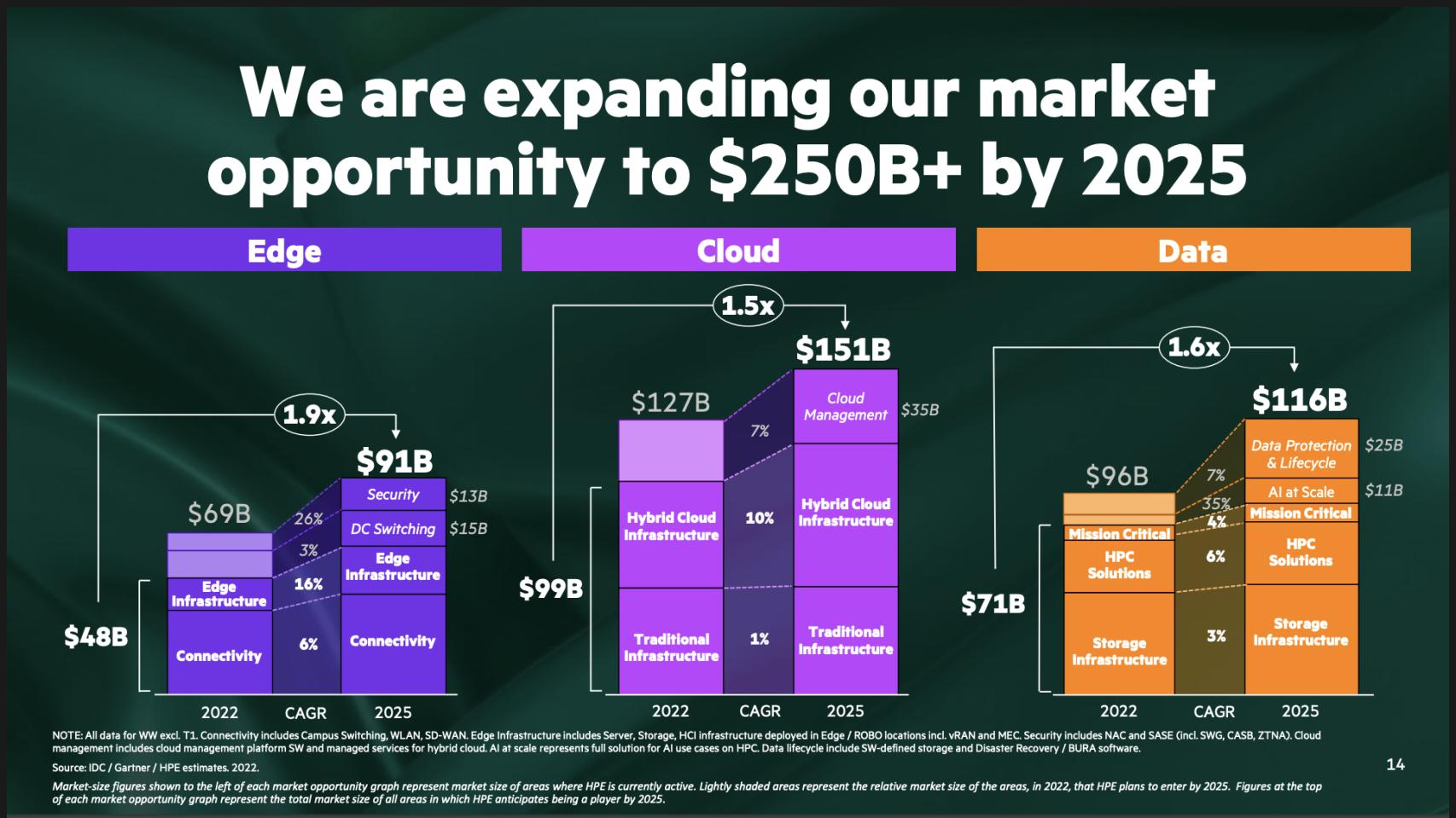

Let’s take a look at how HPE views its total available market.

We love TAM charts because it quantifies how the company sees the opportunity and allows us to see where a firm fits by mapping a company’s views to our market models. And we love big numbers here. Starting with Edge and its granular areas such as networking and security and future telco opportunities. HPE doesn’t specifically call out telco in this chart, but we know, like Dell, it’s eyeing opportunities in OpenRAN and private wireless, as shown by its recent acquisition of Athonet.

Cloud for HPE is all about hybrid. We’ll see if HPE takes the leap into supercloud…. Right now we see HPE very much focused on hybrid versus multicloud, at least that’s what we take away from the narrative. To us that means migrating an installed base to GreenLake and making connections to public cloud where necessary or desirable. But we see incremental opportunity to create value across clouds as a logical next step for any infrastructure player.

Which brings us to data…

Data is super-interesting. Because in the chart you see storage, HPC and Zerto (data protection). But moving up the stack HPE has Ezmeral. Patrick Moorhead at the event asked Neri: Is your strategy to try to build unique IP (for example like Cloudera) and we followed up with questions around HPE’s marketplace/ecosystem strategy. Neri definitely said HPE’s interest is more around building unique IP, rather than building a data ecosystem per se. Although HPE is building a GreenLake ecosystem, so perhaps more discussion is needed here. But we interpreted Antonio’s comments to mean HPE intends to build its own unique IP in data, as well as lifecycle management (shown in the chart). And this can include partners such as Vast Data Inc. But It’s less likely to try to entice data platforms (for example database vendors) to integrate into GreenLake and form a marketplace.

So it begs the question: What is GreenLake? We’ve always looked at it as HPE’s cloud. But maybe it’s HPE’s version of a cloud operating model but not a cloud-like business model where customer optionality is enhanced by an App Store-like experience. Ezmeral got little or no airtime at the event and it’s unclear to us where HPE is going there. Will it do more acquisitions on top of its MapR and other data plays such as Blue Data? In the world of modern data platforms, HPE is not a major player and it’s unclear to us if it aspires to be.

Nonetheless, one thing is clear in that GreenLake encompasses or will encompass all of these areas shown above. Anything HPE does will be “GreenLaked.” We do see GreenLake as HPE’s cloud. And we strongly believe from a business model perspective, marketplaces and ecosystems are a hallmark of clouds and data is the fuel of cloud business models. Perhaps HPE is thinking differently about this. Maybe it’s different when it comes to on-premises or hybrid clouds. As SiliconANGLE CEO John Furrier says, as-a-service offerings such as GreenLake and Dell’s APEX are better versions of Outposts. So maybe that’s the play: Just give existing customers an as-a-service offering and migrate them. But we believe there has to be more.

Customer spending data on HPE networking, servers, storage and cloud

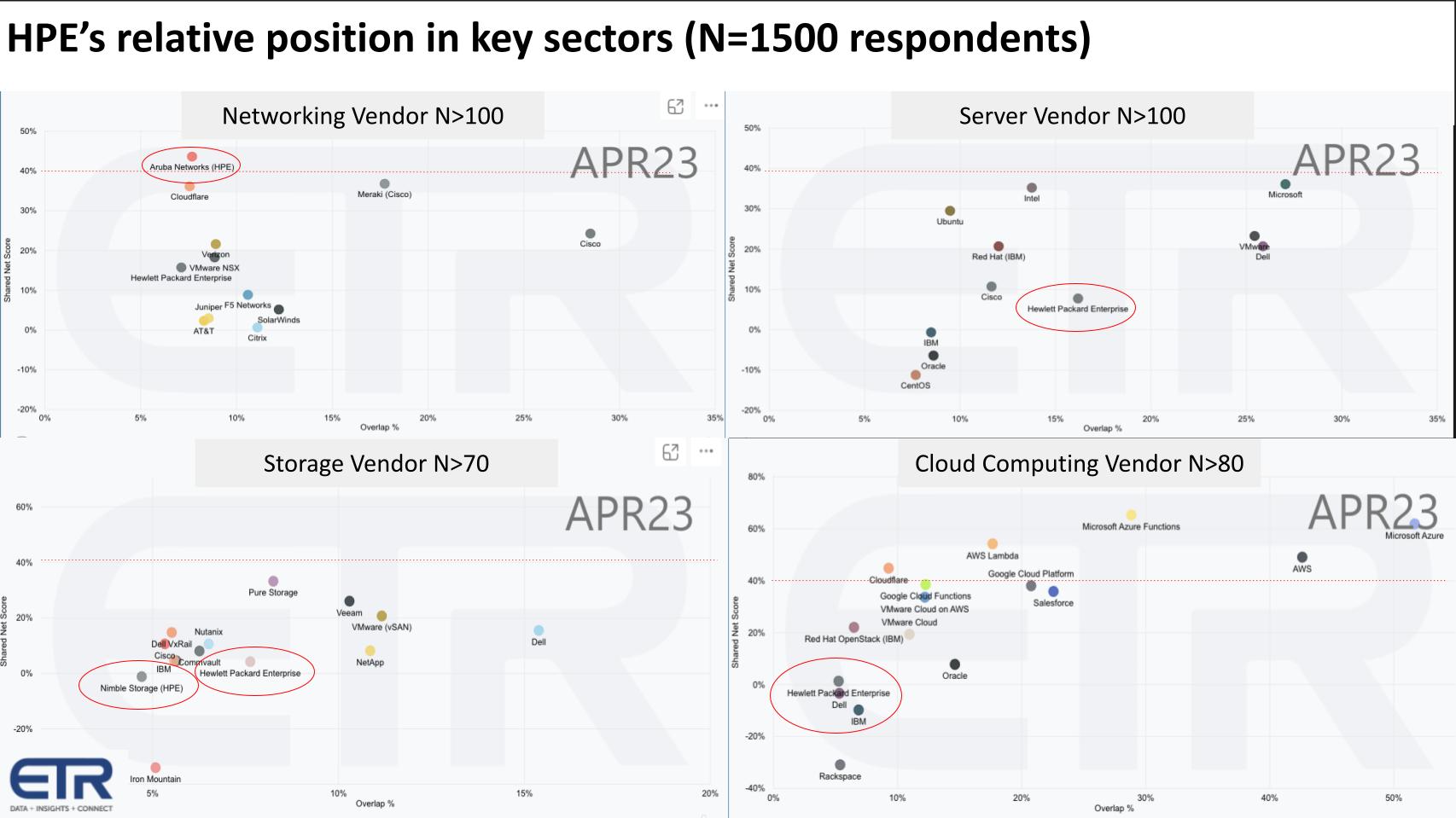

Before we get into the storage takeaways, let’s take a look at the ETR data and see where HPE sits relative to its competitors in four key segments Networks, Servers, Storage and Cloud.

Each chart above has two axes: 1) Net Score on the vertical axis, which is an indicator of spending momentum on a platform within the segment; and 2) Pervasiveness in the data on the X axis, which is a representation of presence in the data set. The red dotted line at 40% on the vertical axis indicates a highly elevated spending momentum on a platform. The survey is from 1,500 IT decision makers and we’ve noted the minimum vendor mentions or N within each chart that we used for a cutoff point.

Bottom lines: 1) HPE kills it in networking from a momentum standpoint and has tons of room to grow to the right; 2) In servers it has a mature business, but it’s driving software content into its platform and has upside in margins; 3) HPE’s storage business is fragmented with a lot of lines and partner products and is in the process of transitioning to its newest platform. The most recent Alletra announcement is designed to bring those lines together; and 4) In cloud, HPE and Dell are just starting to hit the radar of customer surveys.

HPE has a mature business, but it also has growth levers particularly with Aruba that it’s driving horizontally across its portfolio. Aruba Central is the underpinning of GreenLake, for example. As well, HPE is driving its Aruba and networking content across the portfolio in a major way that will drive commonality and cost reductions and will be a time-to-market accelerant.

It’s no coincidence that Tom Black, the head of storage, is a networking expert.

On to GreenLake Storage Day

OK, so this post is supposed to be about storage and we’ve barely touched on it.

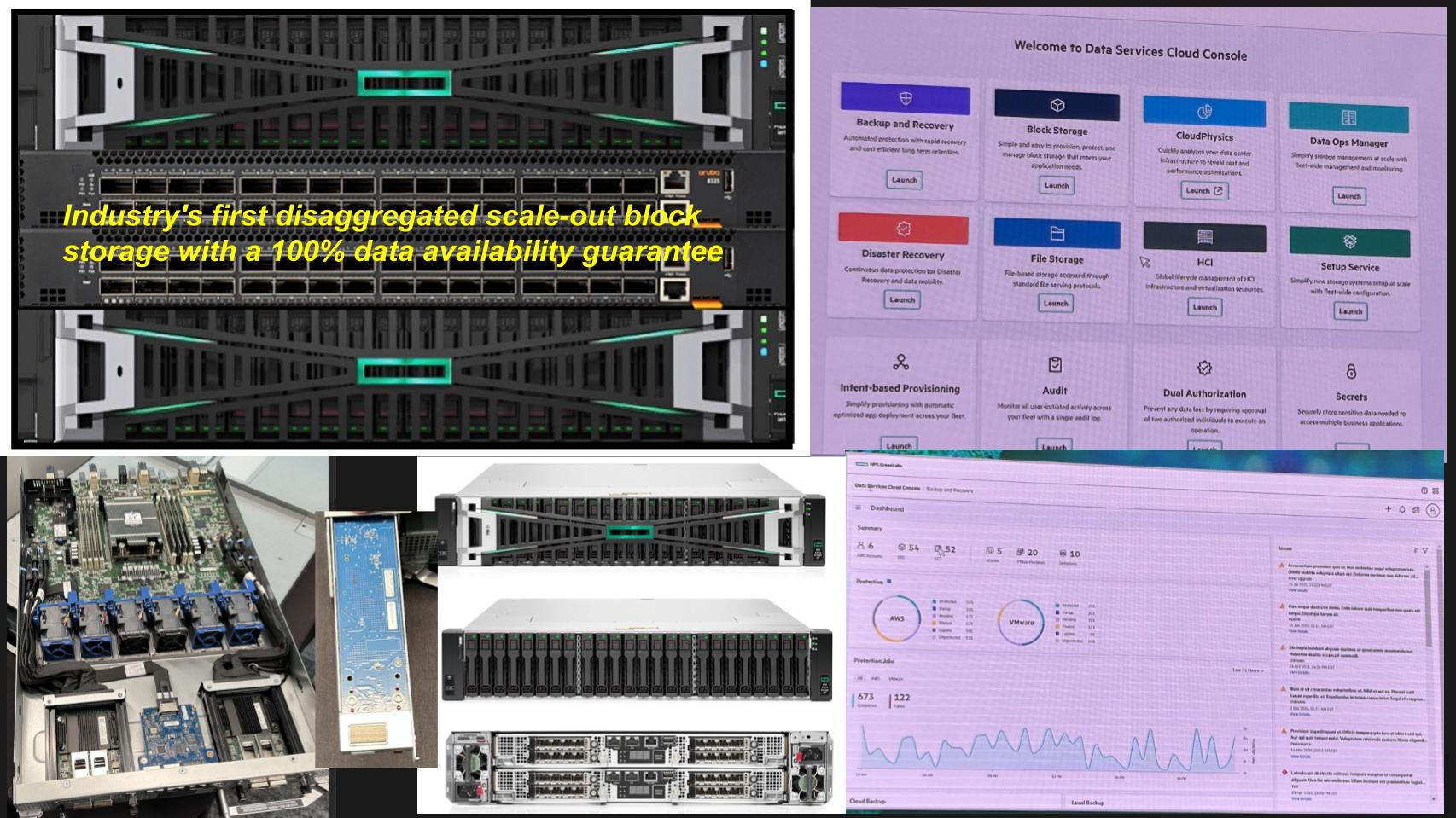

Above is a mashup of some pictures that show what HPE calls the industry’s first disaggregated scale out block storage with a 100% data availability guarantee. We think this is true. HPE has lots of lawyers, so we’re pretty confident its correct. IBM has scale-out block flash, but it’s not disaggregated. Infinidat Ltd. has no proprietary hardware and a 100% data availability guarantee, but it’s scale-up. Pure is scale-up. No company can claim all of these attributes. We’re not sure if it’s game-changing or just good marketing to be the “only” at something, but the market will decide. Our sense is as always in storage it will come down to price/performance, simplicity of management (total cost of ownership), feature sets and the vendor relationship.

What is important is there’s no proprietary hardware in here. The lower left shows a picture of the Alletra MP (for multiprotocol) and that big hunk of metal in the top middle is the processor surrounded by memory DIMMs. The fans are in the middle of the enclosure and that blue card to the right is a persona decoder that can manage the block or file configurations. The Vast file system gets laid on top of this, which is a huge win for Vast.

In fact, Vast execs were there in force. CEO Renen Hallak, co-founder Jeff Denworth and others, right in the front row – no doubt excited. Vast is all about AI and new thinking around data infrastructure. The company has an object solution, but HPE is for now only taking advantage of the Vast file capability. Every analyst on the planet has asked, “What about object?” and the answer has been “stay tuned.”

The three stacked boxes in the bottom middle are the Alletra Storage MP Compute, 2x Aruba switches and a bunch of flash storage in three 8-by groups that connect out of the back end of the open box on the bottom left.

Think of that open box as a controller or really a server that controls the storage and manages all the I/O.

But the one thing we didn’t see get much coverage in the press is what we show on the right with the lame iPhone pictures. That’s the GreenLake Storage Console. This is a cloud-like view of the storage lifecycle and workflow. And the bottom right shows GreenLake data protection (Zerto) reaching into and protecting Amazon Web Services data. Omer Assad was on stage with Keith Townsend, the CTO Advisor, demo-ing this capability. Keith played skeptical analyst and Omer addressed all his questions, which were solid. Keith has a reputation to uphold, no vendor shill.

The point is, GreenLake was first announced during COVID and was a bunch of services and financial mumbo-jumbo. However, in a few short years, it’s actually becoming a real cloud operating model. And that’s probably why HPE hasn’t taken in the Vast object store yet, because they have to certify it for GreenLake and connect it to the APIs and deal with all the backend integration and that takes time. Just as it does with AWS or any other cloud. We suspect going forward, there won’t be many or any partner products announced that don’t integrate with GreenLake.

So high marks for that discipline by HPE – this GreenLake thing is finally getting real after many analyst like myself have been calling for something like this since at least 2018 and even before. We know it’s not easy to change stripes like this, especially for HPE when it was so distracted with the split, but this is going to be a primary platform for customers well into the next decade.

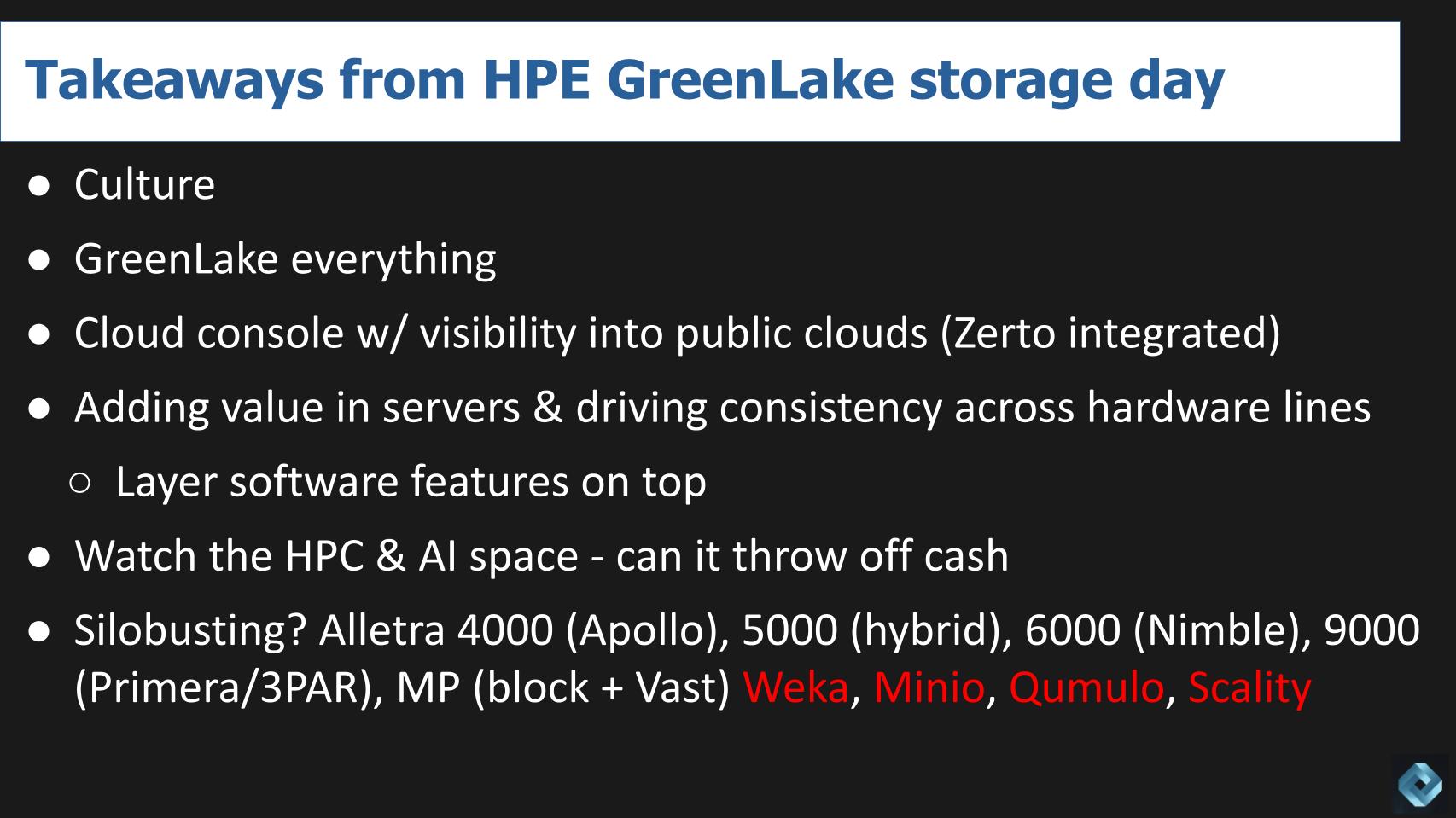

A new era for HPE… winners and losers in the storage announcement

The last thing we want to hit on is some points and takeaways and then unpack the storage announcements a bit more in terms of what they mean for customers, partners and competitors.

HPE’s culture is forming or has re-formed. Think about it – the legacy Bill-and-Dave culture lasted for 75 years, but Neri has had to create a new HPE and he gets really high marks for his enthusiasm, discipline, clarity and execution ethos. HPE is getting stronger, not weaker. HP used to be horrible at acquisitions. HPE is getting really prudent and good at acquiring companies. It’s a new era for sure.

GreenLaking everything is not just words – it’s ground-up effort.

We love the cloud console and the data protection capability is actually tiptoeing with Zerto into supercloud.

For HPE, gaining operating leverage starts with driving consistency across the lines, then adding value with software. For storage, it’s basically standard server components acting as a storage controller containing Aruba IP for connectivity, HPE’s own storage OS, a partner’s file system (Vast in this case) and a bunch of media at the backend. Sounds straightforward, but it takes discipline to stay true to the north star design principles.

In HPC and AI, HPE has a leadership position, we’ll wait and see how it creates the “supercomputing IaaS” that Antonio talked about. Let’s see if HPE can lead in supercomputing cloud. And what about quantum?

Storage is not the root of the silo problem, it’s a symptom

A word on silos. We hear a lot about silos and how X or Y product is going to break down silos. The problem is not storage – siloed storage is a symptom of an application-centric IT stack. With HPE we now have Alletra, which is becoming the go-to platform – the 4000 (Apollo), the 5000 (which is a hybrid array), the 6000 (Nimble), the 9000, which is 3PAR, and we now have the MP with Vast. Even if HPE succeeds in moving all its customers to Alletra, the silo problem will remain until the industry rethinks its data architectures.

For years we’ve automated business processes with applications, and data is locked inside of these apps. We’ve operationalized those business systems to serve specific lines of business, but the data elements that power them remain separate. For data silos to truly break down, business logic has to be embedded in the data and the data elements must be discoverable, accessible, coherent and governed. This will require new thinking for data architectures and how data apps are developed and evolved.

So for now, when HPE talks about breaking down silos, it’s really talking about consolidating its product lines into a single architecture with a software console that is cloud-like and gives admins and developers a single view of their data services.

But HPE still has a number of storage offerings. This announcement can’t be good news for Weka and the whole Minio kerfuffle. Qumulo is an HPE partner and it can’t be too happy with Vast becoming the anointed file partner. And with all this talk about the missing object store.… Remember Scality? It’s an HPE partner. Stay tuned for object was the word and you have to believe that’s going to be Vast. Moreover, one would expect Vast will eventually pop out Weka in HPC.

For customers, these announcements will be aimed at consolidating the installed base and moving it to the new platform. Of special importance is the 3PAR base, which is quite large. Will it open up opportunities for the competition? Probably not so much, as we think GreenLake can be somewhat of a “heat shield” for migration pain. Not that GreenLake makes migration easier per se, but it’s a vision that will compel customers to stick with HPE in our view because although it’s new, it’s more mature than competitive offerings from Dell and more comprehensive than the portfolios of key storage competitors such as Pure and NetApp.

But we’ll see.

The point we’ll leave you with is silos are only partially a function of the storage platform. Perhaps the modern data stack needs a facelift where we truly democratize data for lines of business: data mesh, data fabric, but also a semantic layer which can drive coherence across hundreds, thousands or hundreds of thousands of data elements.

That, however, is a topic for another day.

Keep in touch

Many thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter, and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Leave a Reply