Market sizing is a critical part of business and strategy planning. However, it’s often done wrong. Overly broad and optimistic market assessments usually lead to disappointment.

In this article, I’ll present a practical market sizing case study. Although I’ll base it on a classical TAM/SAM/SOM model, I’ll deviate from the standard approach and suggest a new, more niche-focused model.

The approach I’ll show works best for the 0–1 type of products, and I believe it’ll help you make more grounded and realistic market estimations. Big corporations that already have a strong business presence are subject to different rules when it comes to market sizing.

Table of contents

What is market sizing?

I would define market sizing as “the process of finding the answer to how many users/customers you can realistically get within a certain timeframe.”

Here, we can split it into three groups:

- Total addressable market (TAM): how big is the total market for long-term growth and niche exploration?

- Serviceable attainable market (SAM): what segments can you win in the medium term?

- Serviceable obtainable market (SOM): How much of a niche can you capture first?

The biggest problems with market sizing

There’s one main issue with market sizing — being too broad and overestimating.

When you start your estimation by assuming that “every person in the world” or “every smartphone owner” is your target customer, you are doing it wrong.

The goal of market sizing is, first and foremost, to get a realistic measure that informs your strategy and helps you plan the next steps. A market size of three billion users might look cool on a VC pitch, but can you realistically capture that? Most likely, the answer is no.

Also, try not to look too far into the future. Market sizing should be actionable here and now. You can always reassess the market in the future, but already fantasizing about how many users you will have in 50 years is a poor strategy.

The approach to market sizing

I approach market sizing in four steps:

- Defining an overall target segment.

- Assess a total addressable market. I treat it as “what we can optimistically capture 20 years from now.” I allow myself to be an optimist here, as TAM isn’t supposed to be an actionable metric and serves more as a long-term benchmark

- Choose sub-segment(s) from our TAM that we want to focus on in the medium term (a couple of years from now)

- Niche down until we define a sub-segment that is big enough to meet our business needs but small enough that we can dominate it by providing a tailored experience

How to define your target segment

First of all, understand whom you want to address.

Here we strive to prevent the most common mistake — targeting everyone. Sorry, everyone is not your market.

For example, if you are building a food delivery app in the US, you can’t treat the total US population as your addressable market.

There will be people who are either too old or too young to have a phone. Some people live in small cities, and building a delivery chain there is infeasible. And only a percentage of people are willing to pay for food delivery.

It’s better to be slightly too specific than too broad. Don’t be another “there are eight billion on the planet, if we earn $0.20 from each of them, we’ll rock!” type of founder.

Example case of defining your target market

Researching and choosing the right target segment (and, actually, the type of product you build) is a broad topic and out of the scope of this article.

To keep things simple, let’s assume you and your friend decided to build a financial app. Maybe you both just have a background in finance. And since you like the business environment, you decided to go with B2B.

You did your research and found an unsolved market need with a promising willingness to pay: a payroll management app.

After digging deeper, you realize there’s a difference between corporations and SMEs in that manner, and you choose the latter. And since you are both from the EU, and the EU has a relatively cohesive law, you want to focus there.

So your first version of your target segment is more or less: “SME enterprises based in the EU that need payroll management.”

Don’t overthink if it’s perfect. After going through the process once, you’ll probably revisit step 1 a few times.

Total addressable market (TAM)

Now it’s time to get a high-level number of how many enterprises your target segment consists of.

Two words: desk research. A lot of it.

Try using portals like Statistica and some industry reports, or even ask ChatGPT for suggestions (disclaimer: for this case study, I actually did).

Example of figuring out the TAM

Let’s try to break down our target segment by a list of criteria. What must be true to define something as an “SME enterprise based in the EU that needs payroll management?”

At first glance, it’s:

- A company with less than 250 employees (SME)

- Based in the EU

- In need of payroll management at a scale

The last criterion is a bit tricky, though. How do you measure how many companies need payroll management?

One of the things you could do is conduct qualitative interviews to assess what percentage of companies do payroll management. You can even use a gut feeling. What’s critical is to write down all assumptions you make along the way — we’ll get back to them later.

For the sake of this case, let’s assume you did research and noticed a pattern — companies with less than 100 employees rarely need a dedicated payroll management app. They just use inbuilt features in their accounting software.

So the revised list of criteria would be:

- A company with 100–250 employees

- Based in the EU

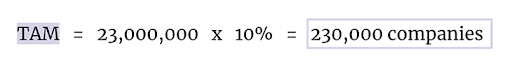

According to the European Commission’s Small and Medium-Sized Enterprises Fact Sheet from June 2021, there are roughly 23 million SMEs in the EU.

Now we need to figure out how many of them have more than 100 employees.

We need additional desk research. Fast forward, let’s say we discovered that roughly one out of 10 SME companies have more than 100 employees. Let’s also note it down to our assumption list:

So we deal with roughly 230,000 companies in the EU.

Serviceable attainable market (SAM)

TAM itself isn’t very actionable. It’s way too broad. Capturing all SMEs with more than 100 employees in the EU is close to impossible.

However, it gives us a baseline from which we can narrow our focus to further sub-segments. It’s useful to both help us find our first target market as well as for further expansion.

Now, the goal is to go deeper. It can have a few layers. For example, you can first narrow down geographically and then to a specific industry.

- Level 1 SAM: specific geography

- Level 2 SAM: specific industry within that geography

The level 2 SAM will help you narrow down your goal to a specific niche. Then, once you want to expand, you can find another industry within your level 1 SAM. Once you saturate your level 1 SAM, you can explore other geographic areas (becoming another level 1 SAM).

It’s worth noting that there are no strict rules on what exactly levels of SAM should be. If, in your case, it makes more sense to narrow down by a specific industry or any other criteria, by all means, go for it.

Example of defining the SAM

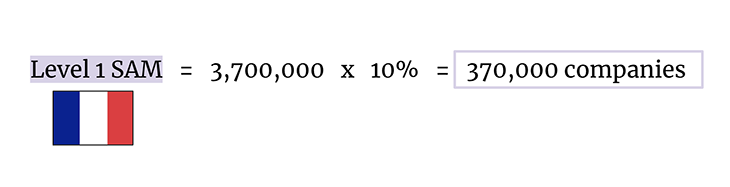

Again, to simplify things, let’s assume that you decided to narrow down geographically first. Say you are located in France; thus, winning this market is the most feasible.

So now the list of criteria is:

- A company with 100–250 employees

- Based in France

Since there are approximately 3.7 million SME companies and we use 10 percent as the benchmark for >100 employees, then our level 1 SAM would be:

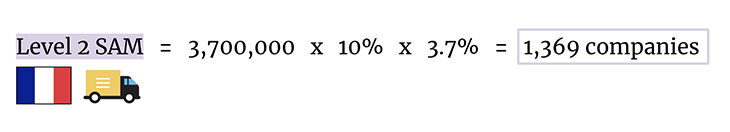

But it’s still pretty broad. Let’s say you did further research and discovered that there’s one specific industry with strong unmet needs: the transportation and storage sector. Workers there work on a shift basis and require payroll management that the competition does not offer. Seems like a winnable segment.

Given that the transportation and storage industry is roughly 3.7 percent of total companies in France, our SAM would look more or less like that:

That looks like a pretty well-defined and focused niche!

Serviceable obtainable market (SOM)

The last question is: how much of your target niche can you actually win?

It’s also a good sanity check. If capturing 10 percent of your SAM is a satisfactory result, then your SAM is still too broad.

The goal of SAM calculations is to define a market you can actually DOMINATE. Without being able to dominate a single niche, you probably won’t be able to find a product-market fit at all.

There are two questions we need to answer

- What percent of the market is even willing to buy our service?

- What percent of that market can we win given the competitive landscape?

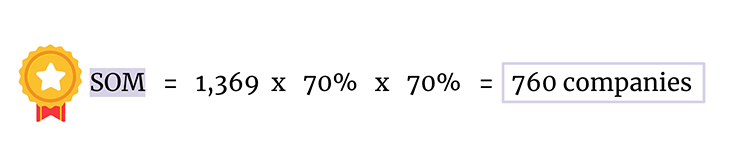

Let’s say you did further research and assumed that roughly 30 percent of the niche is out of the picture — these are laggards that still stick to pen and paper and don’t even want to consider digitalization. There’s no need to evangelize the world.

You also found that there’s relatively low competition in that niche, and you feel confident you can win 70 percent of interested companies (another assumption):

So your short-term niche is roughly 670 companies.

Putting it all together

Now, let’s get insights from the calculations we just did:

- You believe you can win 670 companies as your first niche. Is it big enough to make a profit and grow your business? If that’s not enough, then you should try to explore other SAM segments. If that’s way beyond your needs, then try to narrow down your SAM even more (to a level 3 SAM) and calculate SOM again

- Once you dominate your niche (the level 2 SAM), you can choose from the remaining 35,000 companies (back to the level 1 SAM) to find another niche

- If you achieve great success and begin to scale rapidly, you can reach up to 230,000 companies before needing to innovate your business model to reach brand-new markets (e.g., the US with different tax and payroll laws and procedures). This number is of course inflated, so use it as a baseline to come up with new winnable SAMs

- During your research, you mapped multiple assumptions, such as:

- Companies with >100 employees are more willing to use payroll management apps

- 10 percent of SMEs have more than 100 employees

- 70 percent of your target niche is willing to even try your type of product

- You can win 70 percent of that interested target niche

How validated are these assumptions? How risky are they? What should you focus on validating further?

The odds are that you will need a few more iterations of the exercise. Maybe you didn’t end up with the right numbers the first time, or further assumption testing rendered your assumptions wrong and your numbers were off.

To keep these insights relevant, you also need to repeat the market sizing exercise periodically. Your business model will shift, the market will change, and so on. Relevant data today is obsolete tomorrow.

However, even the first round of properly-led market sizing should give you a healthy dose of insights to help you inform your next steps.

Wrap-up

Market sizing is one of the exercises that can be done really well, thus informing your strategy and next steps, or done really wrong, thus only stroking your ego.

If there’s one thing I want you to take out of this article, it’s that niching down and sub-segmenting is key.

Market sizing should not only tell you what the “best case scenario” might be but also should help you choose and estimate your first niche (SOM) while also giving you a picture of potential expansion (SAM).

Iterate as much as you need to find an ideal go-to-market strategy, and revise your market sizing assessments frequently to keep them relevant.

Featured image source: IconScout

The post A modern approach to market sizing appeared first on LogRocket Blog.

from LogRocket Blog https://ift.tt/kCP8Zen

Gain $200 in a week

via Read more

Source link

Leave a Reply